PDF - Department of the Treasury

PDF - Department of the Treasury

PDF - Department of the Treasury

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

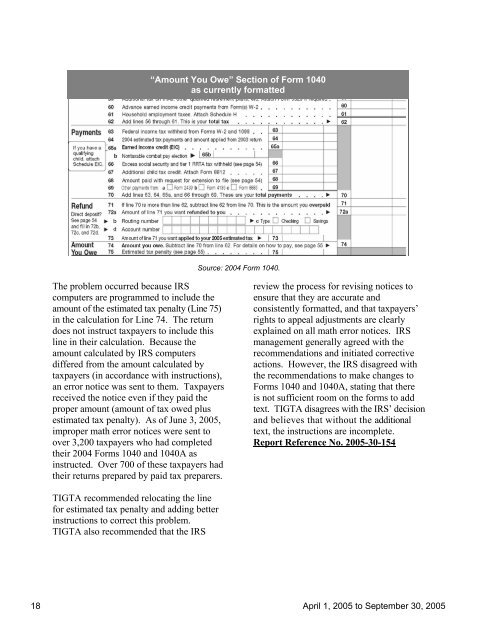

“Amount You Owe” Section <strong>of</strong> Form 1040<br />

as currently formatted<br />

Source: 2004 Form 1040.<br />

The problem occurred because IRS<br />

computers are programmed to include <strong>the</strong><br />

amount <strong>of</strong> <strong>the</strong> estimated tax penalty (Line 75)<br />

in <strong>the</strong> calculation for Line 74. The return<br />

does not instruct taxpayers to include this<br />

line in <strong>the</strong>ir calculation. Because <strong>the</strong><br />

amount calculated by IRS computers<br />

differed from <strong>the</strong> amount calculated by<br />

taxpayers (in accordance with instructions),<br />

an error notice was sent to <strong>the</strong>m. Taxpayers<br />

received <strong>the</strong> notice even if <strong>the</strong>y paid <strong>the</strong><br />

proper amount (amount <strong>of</strong> tax owed plus<br />

estimated tax penalty). As <strong>of</strong> June 3, 2005,<br />

improper math error notices were sent to<br />

over 3,200 taxpayers who had completed<br />

<strong>the</strong>ir 2004 Forms 1040 and 1040A as<br />

instructed. Over 700 <strong>of</strong> <strong>the</strong>se taxpayers had<br />

<strong>the</strong>ir returns prepared by paid tax preparers.<br />

review <strong>the</strong> process for revising notices to<br />

ensure that <strong>the</strong>y are accurate and<br />

consistently formatted, and that taxpayers’<br />

rights to appeal adjustments are clearly<br />

explained on all math error notices. IRS<br />

management generally agreed with <strong>the</strong><br />

recommendations and initiated corrective<br />

actions. However, <strong>the</strong> IRS disagreed with<br />

<strong>the</strong> recommendations to make changes to<br />

Forms 1040 and 1040A, stating that <strong>the</strong>re<br />

is not sufficient room on <strong>the</strong> forms to add<br />

text. TIGTA disagrees with <strong>the</strong> IRS’ decision<br />

and believes that without <strong>the</strong> additional<br />

text, <strong>the</strong> instructions are incomplete.<br />

Report Reference No. 2005-30-154<br />

TIGTA recommended relocating <strong>the</strong> line<br />

for estimated tax penalty and adding better<br />

instructions to correct this problem.<br />

TIGTA also recommended that <strong>the</strong> IRS<br />

18 April 1, 2005 to September 30, 2005