PDF - Department of the Treasury

PDF - Department of the Treasury

PDF - Department of the Treasury

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

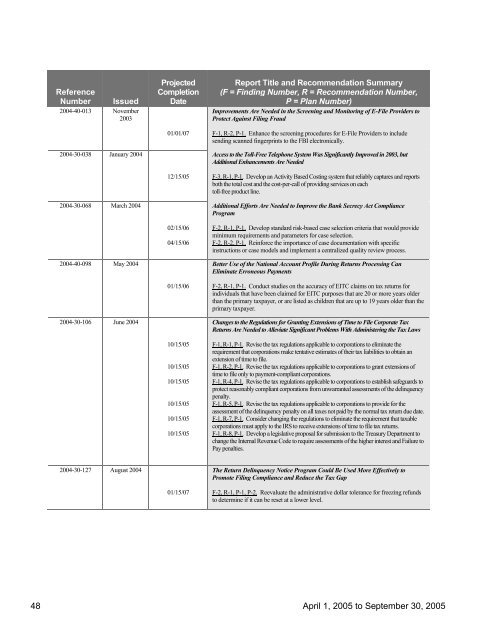

Reference<br />

Number<br />

Issued<br />

2004-40-013 November<br />

2003<br />

2004-30-038 January 2004<br />

2004-30-068 March 2004<br />

2004-40-098 May 2004<br />

2004-30-106 June 2004<br />

Projected<br />

Completion<br />

Date<br />

01/01/07<br />

12/15/05<br />

02/15/06<br />

04/15/06<br />

01/15/06<br />

10/15/05<br />

10/15/05<br />

10/15/05<br />

10/15/05<br />

10/15/05<br />

10/15/05<br />

Report Title and Recommendation Summary<br />

(F = Finding Number, R = Recommendation Number,<br />

P = Plan Number)<br />

Improvements Are Needed in <strong>the</strong> Screening and Monitoring <strong>of</strong> E-File Providers to<br />

Protect Against Filing Fraud<br />

F-1, R-2, P-1. Enhance <strong>the</strong> screening procedures for E-File Providers to include<br />

sending scanned fingerprints to <strong>the</strong> FBI electronically.<br />

Access to <strong>the</strong> Toll-Free Telephone System Was Significantly Improved in 2003, but<br />

Additional Enhancements Are Needed<br />

F-3, R-1, P-1. Develop an Activity Based Costing system that reliably captures and reports<br />

both <strong>the</strong> total cost and <strong>the</strong> cost-per-call <strong>of</strong> providing services on each<br />

toll-free product line.<br />

Additional Efforts Are Needed to Improve <strong>the</strong> Bank Secrecy Act Compliance<br />

Program<br />

F-2, R-1, P-1. Develop standard risk-based case selection criteria that would provide<br />

minimum requirements and parameters for case selection.<br />

F-2, R-2, P-1. Reinforce <strong>the</strong> importance <strong>of</strong> case documentation with specific<br />

instructions or case models and implement a centralized quality review process.<br />

Better Use <strong>of</strong> <strong>the</strong> National Account Pr<strong>of</strong>ile During Returns Processing Can<br />

Eliminate Erroneous Payments<br />

F-2, R-1, P-1. Conduct studies on <strong>the</strong> accuracy <strong>of</strong> EITC claims on tax returns for<br />

individuals that have been claimed for EITC purposes that are 20 or more years older<br />

than <strong>the</strong> primary taxpayer, or are listed as children that are up to 19 years older than <strong>the</strong><br />

primary taxpayer.<br />

Changes to <strong>the</strong> Regulations for Granting Extensions <strong>of</strong> Time to File Corporate Tax<br />

Returns Are Needed to Alleviate Significant Problems With Administering <strong>the</strong> Tax Laws<br />

F-1, R-1, P-1. Revise <strong>the</strong> tax regulations applicable to corporations to eliminate <strong>the</strong><br />

requirement that corporations make tentative estimates <strong>of</strong> <strong>the</strong>ir tax liabilities to obtain an<br />

extension <strong>of</strong> time to file.<br />

F-1, R-2, P-1. Revise <strong>the</strong> tax regulations applicable to corporations to grant extensions <strong>of</strong><br />

time to file only to payment-compliant corporations.<br />

F-1, R-4, P-1. Revise <strong>the</strong> tax regulations applicable to corporations to establish safeguards to<br />

protect reasonably compliant corporations from unwarranted assessments <strong>of</strong> <strong>the</strong> delinquency<br />

penalty.<br />

F-1, R-5, P-1. Revise <strong>the</strong> tax regulations applicable to corporations to provide for <strong>the</strong><br />

assessment <strong>of</strong> <strong>the</strong> delinquency penalty on all taxes not paid by <strong>the</strong> normal tax return due date.<br />

F-1, R-7, P-1. Consider changing <strong>the</strong> regulations to eliminate <strong>the</strong> requirement that taxable<br />

corporations must apply to <strong>the</strong> IRS to receive extensions <strong>of</strong> time to file tax returns.<br />

F-1, R-8, P-1. Develop a legislative proposal for submission to <strong>the</strong> <strong>Treasury</strong> <strong>Department</strong> to<br />

change <strong>the</strong> Internal Revenue Code to require assessments <strong>of</strong> <strong>the</strong> higher interest and Failure to<br />

Pay penalties.<br />

2004-30-127 August 2004<br />

01/15/07<br />

The Return Delinquency Notice Program Could Be Used More Effectively to<br />

Promote Filing Compliance and Reduce <strong>the</strong> Tax Gap<br />

F-2, R-1, P-1, P-2. Reevaluate <strong>the</strong> administrative dollar tolerance for freezing refunds<br />

to determine if it can be reset at a lower level.<br />

48 April 1, 2005 to September 30, 2005