1998 SOUTHERN AFRICA ECONOMIC ... - National Treasury

1998 SOUTHERN AFRICA ECONOMIC ... - National Treasury

1998 SOUTHERN AFRICA ECONOMIC ... - National Treasury

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

d e m a n d s .The declining levels of SADC government deficit<br />

which accompany the falling inflation rates, bear testimony to<br />

this commitment. In 1997, six SADC 1 ) economies re f l e c t e d<br />

government surpluses, with Botswana and Mauritius re c o rd i n g<br />

government surpluses of 8 percent and 4.5 percent re s p e c t i ve ly.<br />

L e s o t h o, S w a z i l a n d , Tanzania and Zambia also re c o rd e d<br />

government surpluses, while Malaw i , M o z a m b i q u e, N a m i b i a ,<br />

South Africa and Zimbabwe reflected government deficits.<br />

i m p o rt cover varied from as high as thirty seven months cove r<br />

( B o t sw a n a ,1996) to as low as 2.4 weeks cover (Mozambique).<br />

1)1997 Government deficit data for A n gola not av a i l a b l e.<br />

BALANCE OF PAY M E N T S<br />

Ty p i c a l ly of the problems curre n t ly facing the developing wo r l d ,<br />

SADC countries continue to experience the constraints in the<br />

balance of pay m e n t s . O n ly five SADC economies (Lesotho,<br />

N a m i b i a ,South A f r i c a ,Swaziland and Zimbabwe ) , had curre n t<br />

account surpluses in 1997 2 ) .<br />

2)1997 data on the balance of payments for Botswana and<br />

Mauritius unav a i l a b l e.<br />

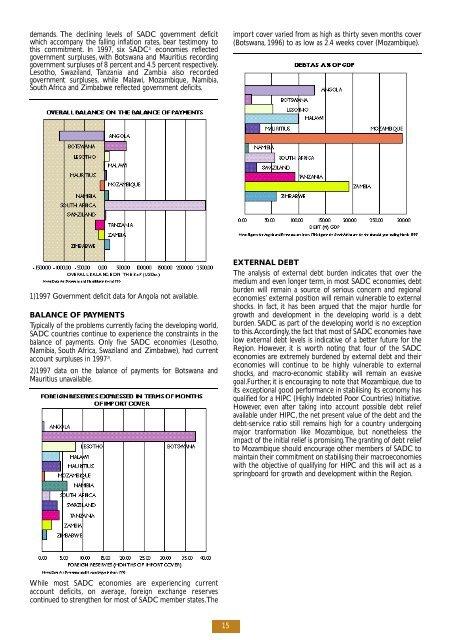

EXTERNAL DEBT<br />

The analysis of external debt burden indicates that over the<br />

medium and even longer term, in most SADC economies, d e b t<br />

b u rden will remain a source of serious concern and re g i o n a l<br />

economies’ external position will remain vulnerable to external<br />

s h o c k s . In fact, it has been argued that the major hurdle fo r<br />

g rowth and development in the developing world is a debt<br />

b u rd e n .SADC as part of the developing world is no exception<br />

to this.A c c o rd i n g ly, the fact that most of SADC economies have<br />

l ow external debt levels is indicative of a better future for the<br />

R e g i o n . H oweve r, it is wo rth noting that four of the SADC<br />

economies are extre m e ly burdened by external debt and their<br />

economies will continue to be highly vulnerable to external<br />

s h o c k s , and macro-economic stability will remain an ev a s i ve<br />

go a l .F u rt h e r, it is encouraging to note that Mozambique, due to<br />

its exceptional good performance in stabilising its economy has<br />

qualified for a HIPC (Highly Indebted Poor Countries) Initiative.<br />

H oweve r, even after taking into account possible debt re l i e f<br />

available under HIPC, the net present value of the debt and the<br />

d e b t - s e rvice ratio still remains high for a country undergo i n g<br />

major tranformation like Mozambique, but nonetheless the<br />

impact of the initial relief is pro m i s i n g .The granting of debt re l i e f<br />

to Mozambique should encourage other members of SADC to<br />

maintain their commitment on stabilising their macro e c o n o m i e s<br />

with the objective of qualifying for HIPC and this will act as a<br />

s p r i n g b o a rd for growth and development within the Region.<br />

While most SADC economies are experiencing curre n t<br />

account deficits, on ave r a g e, fo reign exchange re s e rve s<br />

c o n t i nued to strengthen for most of SADC member states.T h e<br />

15