1998 SOUTHERN AFRICA ECONOMIC ... - National Treasury

1998 SOUTHERN AFRICA ECONOMIC ... - National Treasury

1998 SOUTHERN AFRICA ECONOMIC ... - National Treasury

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

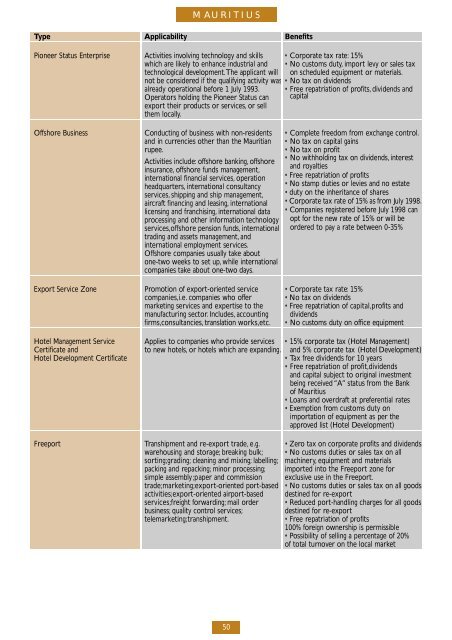

M au r i t i u s<br />

Ty p e A p p l i c a b i l i t y B e n e f i t s<br />

Pioneer Status Enterprise Activities involving technology and skills • Corporate tax rate: 15 %<br />

which are like ly to enhance industrial and • No customs duty, i m p o rt levy or sales tax<br />

technological deve l o p m e n t .The applicant will on scheduled equipment or materials.<br />

not be considered if the qualifying activity was • No tax on dividends<br />

a l ready operational befo re 1 Ju ly 1993. • F ree repatriation of pro f i t s ,dividends and<br />

Operators holding the Pioneer Status can c ap i t a l<br />

e x p o rt their products or serv i c e s ,or sell<br />

them locally.<br />

O f f s h o re Business Conducting of business with non-residents • Complete freedom from exchange contro l .<br />

and in currencies other than the Mauritian • No tax on capital gains<br />

r u p e e.<br />

• No tax on pro f i t<br />

Activities include: o f f s h o re banking, o f f s h o re<br />

• No withholding tax on dividends, i n t e re s t<br />

i n s u r a n c e, o f f s h o re funds management,<br />

and roy a l t i e s<br />

international financial serv i c e s ,operation • Free repatriation of pro f i t s<br />

h e a d q u a rt e r s ,international consultancy • No stamp duties or levies and no estate<br />

s e rv i c e s ,shipping and ship management, • duty on the inheritance of share s<br />

a i rcraft financing and leasing, international • Corporate tax rate of 15% as from Ju ly <strong>1998</strong>.<br />

licensing and franchising, international data • Companies re g i s t e red befo re Ju ly <strong>1998</strong> can<br />

p rocessing and other information technology opt for the new rate of 15% or will be<br />

s e rv i c e s ,o f f s h o re pension funds, international o rd e red to pay a rate between 0-35%<br />

trading and assets management, and<br />

international employment serv i c e s .<br />

O f f s h o re companies usually take about<br />

o n e - t wo weeks to set up, while international<br />

companies take about one-two day s .<br />

E x p o rt Service Zone P romotion of export-oriented service • Corporate tax rate: 15 %<br />

c o m p a n i e s ,i. e. companies who offer • No tax on dividends<br />

m a r keting services and expertise to the • Free repatriation of cap i t a l ,p rofits and<br />

m a nufacturing sector. I n c l u d e s ,accounting d i v i d e n d s<br />

f i r m s ,c o n s u l t a n c i e s ,translation wo r k s ,e t c. • No customs duty on office equipment<br />

Hotel Management Service Applies to companies who provide services • 15% corporate tax (Hotel Management)<br />

C e rtificate and to new hotels, or hotels which are expanding. and 5% corporate tax (Hotel Deve l o p m e n t )<br />

Hotel Development Cert i f i c a t e<br />

• Tax free dividends for 10 ye a r s<br />

• F ree repatriation of pro f i t ,d i v i d e n d s<br />

and capital subject to original investment<br />

being re c e i ved “A” status from the Bank<br />

of Mauritius<br />

• Loans and ove rdraft at pre fe rential rates<br />

• Exemption from customs duty on<br />

i m p o rtation of equipment as per the<br />

ap p roved list (Hotel Deve l o p m e n t )<br />

F re e p o rt Transhipment and re - e x p o rt trade, e. g . • Zero tax on corporate profits and dividends<br />

w a rehousing and storage; b reaking bulk; • No customs duties or sales tax on all<br />

s o rt i n g ;g r a d i n g ; cleaning and mixing; l a b e l l i n g ; m a c h i n e ry, equipment and materials<br />

packing and re p a c k i n g ;minor pro c e s s i n g ; i m p o rted into the Fre e p o rt zone for<br />

simple assembly ;p aper and commission e x c l u s i ve use in the Fre e p o rt .<br />

t r a d e ;m a r ke t i n g ;e x p o rt-oriented port-based • No customs duties or sales tax on all go o d s<br />

a c t i v i t i e s ;e x p o rt-oriented airport-based destined for re - e x p o rt<br />

s e rv i c e s ;f reight fo r w a rd i n g ;mail order • Reduced port-handling charges for all go o d s<br />

b u s i n e s s ;quality control serv i c e s ;<br />

destined for re - e x p o rt<br />

t e l e m a r ke t i n g ;t r a n s h i p m e n t .<br />

• Free repatriation of pro f i t s<br />

100% fo reign ownership is permissible<br />

• Possibility of selling a percentage of 20%<br />

of total turnover on the local marke t<br />

50