Annual Report and Accounts 2009-10 - Welfare Reform impact ...

Annual Report and Accounts 2009-10 - Welfare Reform impact ...

Annual Report and Accounts 2009-10 - Welfare Reform impact ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

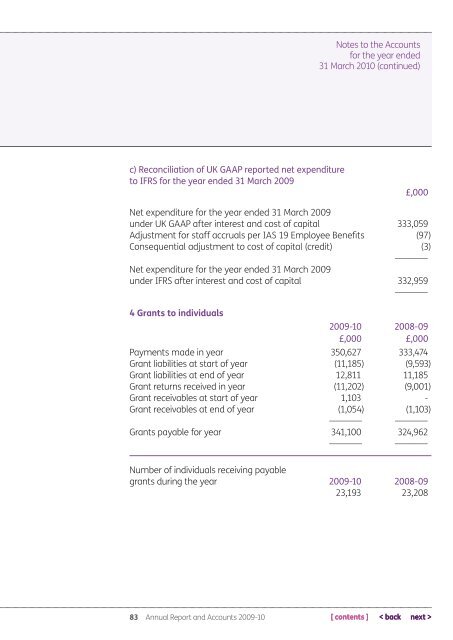

Notes to the <strong>Accounts</strong><br />

for the year ended<br />

31 March 20<strong>10</strong> (continued)<br />

c) Reconciliation of UK GAAP reported net expenditure<br />

to IFRS for the year ended 31 March <strong>2009</strong><br />

£,000<br />

Net expenditure for the year ended 31 March <strong>2009</strong><br />

under UK GAAP after interest <strong>and</strong> cost of capital 333,059<br />

Adjustment for staff accruals per IAS 19 Employee Benefits (97)<br />

Consequential adjustment to cost of capital (credit) (3)<br />

--------------<br />

Net expenditure for the year ended 31 March <strong>2009</strong><br />

under IFRS after interest <strong>and</strong> cost of capital 332,959<br />

--------------<br />

4 Grants to individuals<br />

<strong>2009</strong>-<strong>10</strong> 2008-09<br />

£,000 £,000<br />

Payments made in year 350,627 333,474<br />

Grant liabilities at start of year (11,185) (9,593)<br />

Grant liabilities at end of year 12,811 11,185<br />

Grant returns received in year (11,202) (9,001)<br />

Grant receivables at start of year 1,<strong>10</strong>3 -<br />

Grant receivables at end of year (1,054) (1,<strong>10</strong>3)<br />

-------------- --------------<br />

Grants payable for year 341,<strong>10</strong>0 324,962<br />

-------------- --------------<br />

Number of individuals receiving payable<br />

grants during the year <strong>2009</strong>-<strong>10</strong> 2008-09<br />

23,193 23,208<br />

83 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2009</strong>-<strong>10</strong>