Annual Report and Accounts 2009-10 - Welfare Reform impact ...

Annual Report and Accounts 2009-10 - Welfare Reform impact ...

Annual Report and Accounts 2009-10 - Welfare Reform impact ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

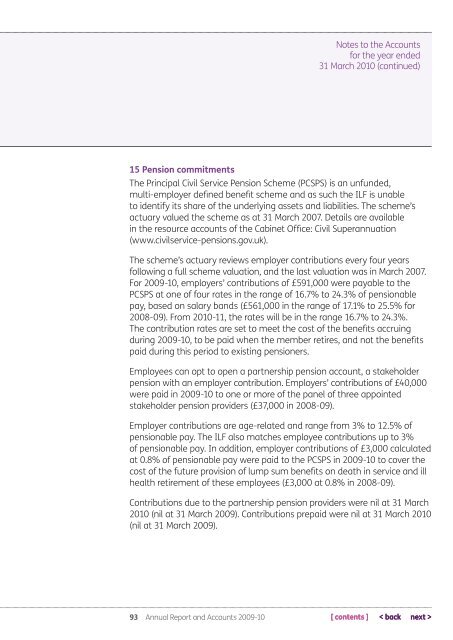

Notes to the <strong>Accounts</strong><br />

for the year ended<br />

31 March 20<strong>10</strong> (continued)<br />

15 Pension commitments<br />

The Principal Civil Service Pension Scheme (PCSPS) is an unfunded,<br />

multi-employer defined benefit scheme <strong>and</strong> as such the ILF is unable<br />

to identify its share of the underlying assets <strong>and</strong> liabilities. The scheme’s<br />

actuary valued the scheme as at 31 March 2007. Details are available<br />

in the resource accounts of the Cabinet Office: Civil Superannuation<br />

(www.civilservice-pensions.gov.uk).<br />

The scheme’s actuary reviews employer contributions every four years<br />

following a full scheme valuation, <strong>and</strong> the last valuation was in March 2007.<br />

For <strong>2009</strong>-<strong>10</strong>, employers’ contributions of £591,000 were payable to the<br />

PCSPS at one of four rates in the range of 16.7% to 24.3% of pensionable<br />

pay, based on salary b<strong>and</strong>s (£561,000 in the range of 17.1% to 25.5% for<br />

2008-09). From 20<strong>10</strong>-11, the rates will be in the range 16.7% to 24.3%.<br />

The contribution rates are set to meet the cost of the benefits accruing<br />

during <strong>2009</strong>-<strong>10</strong>, to be paid when the member retires, <strong>and</strong> not the benefits<br />

paid during this period to existing pensioners.<br />

Employees can opt to open a partnership pension account, a stakeholder<br />

pension with an employer contribution. Employers’ contributions of £40,000<br />

were paid in <strong>2009</strong>-<strong>10</strong> to one or more of the panel of three appointed<br />

stakeholder pension providers (£37,000 in 2008-09).<br />

Employer contributions are age-related <strong>and</strong> range from 3% to 12.5% of<br />

pensionable pay. The ILF also matches employee contributions up to 3%<br />

of pensionable pay. In addition, employer contributions of £3,000 calculated<br />

at 0.8% of pensionable pay were paid to the PCSPS in <strong>2009</strong>-<strong>10</strong> to cover the<br />

cost of the future provision of lump sum benefits on death in service <strong>and</strong> ill<br />

health retirement of these employees (£3,000 at 0.8% in 2008-09).<br />

Contributions due to the partnership pension providers were nil at 31 March<br />

20<strong>10</strong> (nil at 31 March <strong>2009</strong>). Contributions prepaid were nil at 31 March 20<strong>10</strong><br />

(nil at 31 March <strong>2009</strong>).<br />

93 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2009</strong>-<strong>10</strong>