Annual Report 2006/2007 KGaA/Group - BVB Aktie - Borussia ...

Annual Report 2006/2007 KGaA/Group - BVB Aktie - Borussia ...

Annual Report 2006/2007 KGaA/Group - BVB Aktie - Borussia ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GROUP MANAGEMENT REPORT<br />

The capital increase resolved by the extraordinary<br />

General Shareholders' Meeting of <strong>Borussia</strong><br />

Dortmund GmbH & Co. <strong>KGaA</strong> on 15 August <strong>2006</strong><br />

for a nominal amount of up to EUR 17,550,000 to<br />

EUR 61,425,000 was fully placed. The indirect subscription<br />

right for a total of 7,567,585 new shares<br />

was exercised by the Company's limited liability<br />

shareholders. Morgan Stanley & Co. International<br />

Limited, London, England (“MSIL”) subscribed for<br />

an additional 9,982,415 new shares in accordance<br />

with the resolution authorising the capital increase<br />

dated 15 August <strong>2006</strong>. MSIL paid in its non-cash<br />

contribution by assigning to the Company a partial<br />

claim held by its sister company, Morgan Stanley<br />

Bank International Limited, against the Company<br />

for a nominal amount of EUR 21,961,313.<br />

The capital increase was entered in the commercial<br />

register of the Local Court of Dortmund on 19<br />

September <strong>2006</strong>. Thus, the Company's share capital<br />

is EUR 61,425,000 (previously EUR 43,875,000) and<br />

is divided into the same amount of no-par value<br />

shares. Management used EUR 10 million of the new<br />

cash funds generated from the capital increase<br />

(approximately EUR 15.1 million in total) to finance<br />

working capital and put the remainder toward reducing<br />

existing liabilities.<br />

The restructuring of the liability side of the balance<br />

sheet, with the aim of strengthening equity resources,<br />

achieving a more manageable debt maturity structure<br />

and improving interest rate terms, has now been fully<br />

implemented.<br />

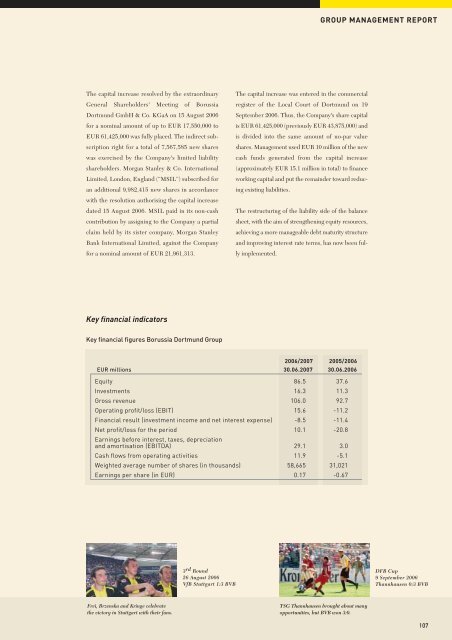

Key financial indicators<br />

Key financial figures <strong>Borussia</strong> Dortmund <strong>Group</strong><br />

<strong>2006</strong>/<strong>2007</strong> 2005/<strong>2006</strong><br />

EUR millions 30.06.<strong>2007</strong> 30.06.<strong>2006</strong><br />

Equity 86.5 37.6<br />

Investments 16.3 11.3<br />

Gross revenue 106.0 92.7<br />

Operating profit/loss (EBIT) 15.6 -11.2<br />

Financial result (investment income and net interest expense) -8.5 -11.4<br />

Net profit/loss for the period 10.1 -20.8<br />

Earnings before interest, taxes, depreciation<br />

and amortisation (EBITDA) 29.1 3.0<br />

Cash flows from operating activities 11.9 -5.1<br />

Weighted average number of shares (in thousands) 58,665 31,021<br />

Earnings per share (in EUR) 0.17 -0.67<br />

3 rd Round<br />

26 August <strong>2006</strong><br />

VfB Stuttgart 1:3 <strong>BVB</strong><br />

DFB Cup<br />

9 September <strong>2006</strong><br />

Thannhausen 0:3 <strong>BVB</strong><br />

Frei, Brzenska and Kringe celebrate<br />

the victory in Stuttgart with their fans.<br />

TSG Thannhausen brought about many<br />

opportunities, but <strong>BVB</strong> won 3:0.<br />

107