The Price of Illicit Drugs: 1981 through the - The White House

The Price of Illicit Drugs: 1981 through the - The White House

The Price of Illicit Drugs: 1981 through the - The White House

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

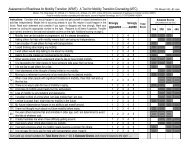

<strong>Price</strong>s at each distribution level fell markedly from <strong>1981</strong> to about 1988, after which price decreases have<br />

been gradual and irregular. 10 For example, at <strong>the</strong> lowest distribution level reported here, <strong>the</strong> typical<br />

purchase <strong>of</strong> 350 milligrams <strong>of</strong> pure cocaine (that is, about 0.5 bulk grams at 67 percent purity) cost $400 to<br />

$460 per pure gram in <strong>1981</strong> and 1982. It cost $170 to $230 per pure gram in 1999 and 2000. Similarly, at<br />

<strong>the</strong> next higher distribution level, <strong>the</strong> typical purchase <strong>of</strong> 4.4 grams <strong>of</strong> pure cocaine (that is, almost 7 bulk<br />

grams at 63 percent purity) costs roughly $260 to $300 in <strong>1981</strong> and 1982. A purchase cost around $90 to<br />

$100 per pure gram in 1997 and 1998.<br />

Figure 1 shows that some price increases at <strong>the</strong> wholesale level seem to cascade <strong>through</strong>out all <strong>the</strong> lower<br />

distribution levels, perhaps suggesting that events ei<strong>the</strong>r outside <strong>the</strong> country or at <strong>the</strong> wholesale level affect<br />

retail prices. <strong>The</strong> largest and longest lasting effect is associated with <strong>the</strong> end <strong>of</strong> 1989 and <strong>the</strong> beginning <strong>of</strong><br />

1990, with ano<strong>the</strong>r sharp effect happening in <strong>the</strong> second quarter <strong>of</strong> 1992 and again in <strong>the</strong> first quarter <strong>of</strong><br />

1997. <strong>Price</strong>s may have spiked in <strong>the</strong> middle <strong>of</strong> 1995, but if <strong>the</strong>y did, that spike only appears after a lag at<br />

<strong>the</strong> lowest distribution level.<br />

Associating <strong>the</strong>se price spikes with specific drug interdiction events is problematic. It seems likely that<br />

some interdiction events had measurable effects on cocaine prices, while o<strong>the</strong>rs did not, and distinguishing<br />

which events had an effect and which did not is complicated by <strong>the</strong> absence <strong>of</strong> knowledge about <strong>the</strong> delay<br />

between when an event occurred and when prices changed. Notwithstanding <strong>the</strong>se difficulties, Abt<br />

Associates has made substantial progress modeling <strong>the</strong> interdiction-price relationship for cocaine. 11<br />

<strong>The</strong> relationship between wholesale and retail prices is <strong>of</strong> considerable interest. <strong>The</strong> correlation between<br />

wholesale and retail prices is 0.46, and even though this estimate is technically inappropriate, it does<br />

correctly portray <strong>the</strong> fact that both price series tend to move toge<strong>the</strong>r. In fact transfer function methods<br />

(which are technically more appropriate because <strong>the</strong>y model various time series aspects <strong>of</strong> <strong>the</strong> data)<br />

indicate that increases in wholesale prices are associated with lagged as well as contemporaneous<br />

increases in retail prices (see section 7 <strong>of</strong> Appendix A). Specifically, we estimate that an increase in retail<br />

prices <strong>of</strong> $1 in a given month is associated with an increase in wholesale prices <strong>of</strong> $0.034 (p = 0.001) <strong>the</strong><br />

10 Most <strong>of</strong> <strong>the</strong> decline since 1988 can be attributed to an increase in <strong>the</strong> consumer price index. Whe<strong>the</strong>r <strong>the</strong> CPI<br />

should be applied to illicit drug transactions, or whe<strong>the</strong>r an alternative price index would be better, is debatable.<br />

<strong>The</strong>se price estimates use <strong>the</strong> CPI in lieu <strong>of</strong> a clear alternative.<br />

11 Layne M., Bruen, A., Johnston P., Rhodes W., Decker S., Townsend M., Chester C., Schaffer G., Lavin J.<br />

“Measuring <strong>the</strong> Deterrent Effect <strong>of</strong> Enforcement Operations on Drug Smuggling, 1991-1999,” Abt Associates<br />

2001.<br />

7