The Price of Illicit Drugs: 1981 through the - The White House

The Price of Illicit Drugs: 1981 through the - The White House

The Price of Illicit Drugs: 1981 through the - The White House

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

From <strong>the</strong> viewpoint <strong>of</strong> <strong>the</strong> model, <strong>the</strong> Rest <strong>of</strong> U.S. is just ano<strong>the</strong>r “city”, and at times we use <strong>the</strong><br />

shorthand “30 cities” for “<strong>the</strong> 29 large U.S. cities and <strong>the</strong> Rest <strong>of</strong> U.S.”.<br />

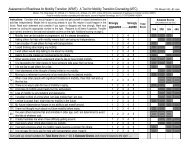

<strong>The</strong> distribution level has no precise definition, but <strong>the</strong> intention was to distinguish purchases that<br />

were predominantly retail (Level 1) from those involving dealers (Level 2 and above). <strong>The</strong> levels,<br />

inclusive <strong>of</strong> <strong>the</strong> upper limit, were as follows: cocaine (0-1, 1-10, 10-100, >100 pure grams); heroin<br />

(0-0.1, 0.1-1, 1-10, >10 pure grams); methamphetamine (0-10, 10-100, >100 pure grams);<br />

marijuana (0-10, 10-100, 100-1,000, >1,000 bulk grams).<br />

3. A Model for <strong>Price</strong><br />

For each drug and each level <strong>of</strong> distribution, we regressed standardized price against standardized<br />

amount, purity, time and city. For <strong>the</strong> reason just outlined, purity was not included in <strong>the</strong> model<br />

for marijuana. Because price changes over short periods <strong>of</strong> time are <strong>of</strong> interest, both time and city<br />

were treated as factors (with 78 and 30 levels respectively). Had time been treated continuously,<br />

means estimated by <strong>the</strong> model would not have exhibited short-term fluctuations in price.<br />

<strong>The</strong> regression model took <strong>the</strong> form <strong>of</strong> a generalized linear model with log link function,<br />

logarithmic predictors, and constant coefficient <strong>of</strong> variation (McCullagh and Nelder, 1989, ch. 8).<br />

This model implies <strong>the</strong> following mean and variance specifications:<br />

E(price itj ) = exp( + city i + time t + log(amount itj ) + log(purity itj )) (1)<br />

V(price itj ) = E 2 (price itj ) (2)<br />

In <strong>the</strong>se expressions, price itj represents <strong>the</strong> jth observation from <strong>the</strong> ith city at <strong>the</strong> tth time period,<br />

with covariate values amount itj and purity itj . E(price itj ) is <strong>the</strong> mean value <strong>of</strong> price itj , and V(price itj )<br />

is its variance. is a dispersion parameter analogous to 2 in a linear model based on least<br />

squares.<br />

Estimation and inference for <strong>the</strong> above model was carried out via <strong>the</strong> method <strong>of</strong> quasi-maximum<br />

likelihood. Under distributional assumptions involving only <strong>the</strong> first two moments (those<br />

embodied in (1) and (2)), quasi-maximum likelihood estimates are consistent and asymptotically<br />

A-6