The Price of Illicit Drugs: 1981 through the - The White House

The Price of Illicit Drugs: 1981 through the - The White House

The Price of Illicit Drugs: 1981 through the - The White House

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

very reasonable, particularly given that <strong>the</strong> length <strong>of</strong> <strong>the</strong> required extrapolation was nearly as long<br />

as <strong>the</strong> range <strong>of</strong> observable data.<br />

7. <strong>The</strong> Relationship Between Retail and Wholesale <strong>Price</strong>s<br />

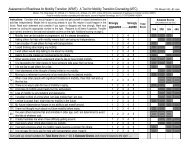

It is <strong>of</strong> interest to know <strong>the</strong> relationship between retail and wholesale prices. This is not a simple<br />

matter <strong>of</strong> regressing one price on <strong>the</strong> o<strong>the</strong>r. Ra<strong>the</strong>r, one must account for <strong>the</strong> fact that both<br />

variables are time series with particular correlation structures which affect each o<strong>the</strong>r in a possibly<br />

delayed or dynamic fashion (Box et. al, 1994). We illustrate an approach to this bivariate time<br />

series problem for cocaine prices over <strong>the</strong> last decade 1991-2000. Retail prices were based on a<br />

monthly version <strong>of</strong> <strong>the</strong> method described in section 4, and wholesale prices were based on a<br />

monthly version <strong>of</strong> <strong>the</strong> method described in section 3. <strong>The</strong> two price series are shown in Figure<br />

A5.<br />

<strong>The</strong> correlation between <strong>the</strong> two price series is 0.46, and even though this estimate is technically<br />

inappropriate, it does correctly portray <strong>the</strong> fact that both price series tend to move toge<strong>the</strong>r. <strong>The</strong><br />

technical problem arises because a simple correlation coefficient ignores <strong>the</strong> time series nature <strong>of</strong><br />

<strong>the</strong> two series: its validity assumes firstly that observations in each price series are independent<br />

ra<strong>the</strong>r than autocorrelated, and secondly that <strong>the</strong> correlation between <strong>the</strong> two series is<br />

contemporaneous ra<strong>the</strong>r than delayed, dynamic (involving lags <strong>of</strong> some sort), or both.<br />

A-17