Reports - United Nations Development Programme

Reports - United Nations Development Programme

Reports - United Nations Development Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COUNTRY EVALUATION: ASSESSMENT OF DEVELOPMENT RESULTS – TURKEY<br />

14<br />

2002, and the AKP party leader, Recep Tayyip Erdoğan,<br />

took over as Prime Minister in early 2003, the<br />

Government has consistently pursued political and<br />

economic stability and reform in the quest for the<br />

overarching national goal of Turkey’s accession to the EU.<br />

As a result, the AKP has been able to strengthen its<br />

popular support and it scored a clear victory in the<br />

municipal elections in April 2004. At this point it is<br />

expected that AKP will continue in power until at least<br />

the next national parliamentary elections in 2007.<br />

B. A VOLATILE ECONOMY<br />

Turkey is a large middle-income country, with purchasing<br />

power parity GDP per capita at about USD 5,890 in<br />

2001. 3 Some two-thirds of its population of almost 70<br />

million lived in urban areas in 2001. Agriculture accounts<br />

for 16% of its GDP, industry for 24%, and services for<br />

60%. Turkey’s economy grew at an average annual rate of<br />

4% between 1965 and 2001, with its real per capita GDP<br />

growing at just under half that rate due to rapid<br />

population growth. This long-term growth performance<br />

makes Turkey less successful than many of its competitors<br />

among the dynamic, emerging market economies located<br />

mostly in East and Southeast Asia and Latin America.<br />

Korea, Thailand and Malaysia grew two to three times<br />

more rapidly in per capita terms over the same period,<br />

and Brazil, India and Chile also outperformed Turkey,<br />

with average annual per capita GDP growth rates well<br />

above 2%. 4<br />

A key reason for Turkey’s less than stellar economic<br />

performance has been the fact that its growth was highly<br />

volatile over the last two decades with repeated booms<br />

and busts, accompanied by persistently high inflation. At<br />

the core of this pattern of instability were the growing<br />

fiscal imbalances in Turkey, especially in the 1990s, with<br />

high and growing public sector deficits, borrowing<br />

requirements and hence substantial increases in total<br />

public debt. 5 In addition, substantial hidden public<br />

liabilities were accumulated in an unsound banking sector,<br />

with many large and inefficient public banks and poorly<br />

supervised private banks becoming increasingly insolvent.<br />

Matters came to a head in the late 1990s after the<br />

1997-98 financial crisis in East Asia and Russia had<br />

————————————————————————————————————<br />

3. UNDP, “Human <strong>Development</strong> Report 2003”, p. 238. Turkey was marginally ahead of<br />

Romania with a PPP GDP per capita of USD 5,830. At current exchange rates,<br />

Turkey’s GNI per capita was about USD 2,500 in 2002, according to World<br />

<strong>Development</strong> Indicators.<br />

4. The World Bank, “Country Economic Memorandum”, October 2003; and The World<br />

Bank, “Turkey Country Brief”, September 2003.<br />

5. Ibid.<br />

severely reduced the trust of international capital markets<br />

in emerging market economies. The knock-on effect of<br />

the regional and worldwide economic slowdown exposed<br />

Turkey’s weak macroeconomic fundamentals. Two major<br />

earthquakes during the second half of 1999 further<br />

damaged Turkey’s outlook, resulting in a severe economic<br />

contraction that year.<br />

Recognising the long-term unsustainability of the<br />

economy’s trends, the Turkish authorities initiated a major<br />

economic reform programme in 1999. This included an<br />

exchange-rate based disinflation programme and<br />

encompassed ambitious structural reforms, including a<br />

banking sector workout, fiscal and public sector reforms,<br />

as well as agricultural and energy sector reforms and<br />

privatisation. Initially, confidence in the Turkish economy<br />

rebounded and it recovered dramatically in 2000.<br />

However, accumulated financial imbalances, political<br />

wrangling among the Government coalition partners and<br />

continued international market jitters plunged Turkey<br />

back into economic crisis starting in late 2000. During<br />

2001, Turkey’s economy contracted by 7.5%, while the<br />

public debt-to-GDP ratio reached almost 100%. This led<br />

the Government in May 2001 to abandon the exchange<br />

rate anchor and to announce a new, even more ambitious<br />

economic programme involving dramatic fiscal stabilisation,<br />

further banking, energy and agricultural sector restructuring,<br />

and an intensified privatisation and public sector<br />

reform programme. These macroeconomic and structural<br />

reforms were complemented by efforts to strengthen the<br />

social safety net to help protect the most vulnerable<br />

population groups from the negative impact of the<br />

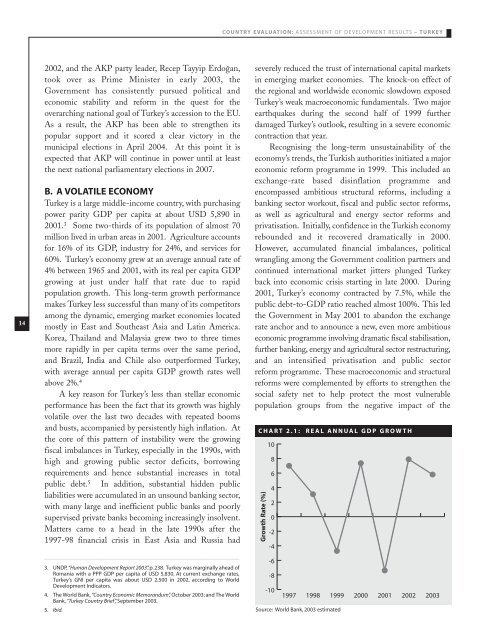

CHART 2.1:<br />

Growth Rate (%)<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

1997<br />

1998<br />

1999<br />

Source: World Bank, 2003 estimated<br />

REAL ANNUAL GDP GRO WTH<br />

2000<br />

2001<br />

2002<br />

2003