annual report/2006 - University of Melbourne

annual report/2006 - University of Melbourne

annual report/2006 - University of Melbourne

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

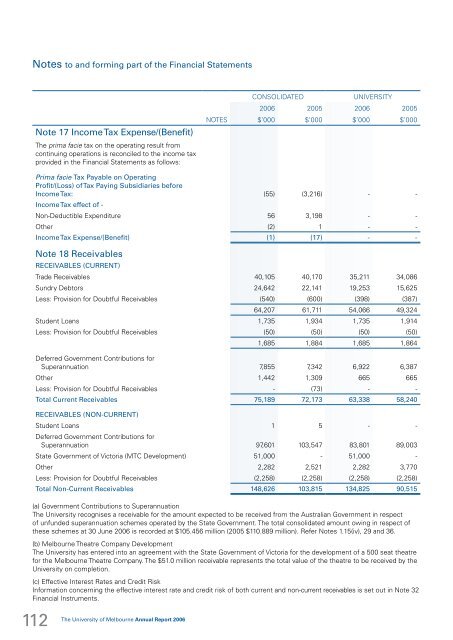

Notes to and forming part <strong>of</strong> the Financial Statements<br />

Note 17 Income Tax Expense/(Benefit)<br />

The prima facie tax on the operating result from<br />

continuing operations is reconciled to the income tax<br />

provided in the Financial Statements as follows:<br />

CONSOLIDATED<br />

UNIVERSITY<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

NOTES $’000 $’000 $’000 $’000<br />

Prima facie Tax Payable on Operating<br />

Pr<strong>of</strong>it/(Loss) <strong>of</strong> Tax Paying Subsidiaries before<br />

Income Tax: (55) (3,216) - -<br />

Income Tax effect <strong>of</strong> -<br />

Non-Deductible Expenditure 56 3,198 - -<br />

Other (2) 1 - -<br />

Income Tax Expense/(Benefit) (1) (17) - -<br />

Note 18 Receivables<br />

RECEIVABLES (CURRENT)<br />

Trade Receivables 40,105 40,170 35,211 34,086<br />

Sundry Debtors 24,642 22,141 19,253 15,625<br />

Less: Provision for Doubtful Receivables (540) (600) (398) (387)<br />

64,207 61,711 54,066 49,324<br />

Student Loans 1,735 1,934 1,735 1,914<br />

Less: Provision for Doubtful Receivables (50) (50) (50) (50)<br />

1,685 1,884 1,685 1,864<br />

Deferred Government Contributions for<br />

Superannuation 7,855 7,342 6,922 6,387<br />

Other 1,442 1,309 665 665<br />

Less: Provision for Doubtful Receivables - (73) - -<br />

Total Current Receivables 75,189 72,173 63,338 58,240<br />

RECEIVABLES (NON-CURRENT)<br />

Student Loans 1 5 - -<br />

Deferred Government Contributions for<br />

Superannuation 97,601 103,547 83,801 89,003<br />

State Government <strong>of</strong> Victoria (MTC Development) 51,000 - 51,000 -<br />

Other 2,282 2,521 2,282 3,770<br />

Less: Provision for Doubtful Receivables (2,258) (2,258) (2,258) (2,258)<br />

Total Non-Current Receivables 148,626 103,815 134,825 90,515<br />

(a) Government Contributions to Superannuation<br />

The <strong>University</strong> recognises a receivable for the amount expected to be received from the Australian Government in respect<br />

<strong>of</strong> unfunded superannuation schemes operated by the State Government. The total consolidated amount owing in respect <strong>of</strong><br />

these schemes at 30 June <strong>2006</strong> is recorded at $105.456 million (2005 $110.889 million). Refer Notes 1.15(iv), 29 and 36.<br />

(b) <strong>Melbourne</strong> Theatre Company Development<br />

The <strong>University</strong> has entered into an agreement with the State Government <strong>of</strong> Victoria for the development <strong>of</strong> a 500 seat theatre<br />

for the <strong>Melbourne</strong> Theatre Company. The $51.0 million receivable represents the total value <strong>of</strong> the theatre to be received by the<br />

<strong>University</strong> on completion.<br />

(c) Effective Interest Rates and Credit Risk<br />

Information concerning the effective interest rate and credit risk <strong>of</strong> both current and non-current receivables is set out in Note 32<br />

Financial Instruments.<br />

112<br />

The <strong>University</strong> <strong>of</strong> <strong>Melbourne</strong> Annual Report <strong>2006</strong>