annual report/2006 - University of Melbourne

annual report/2006 - University of Melbourne

annual report/2006 - University of Melbourne

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to and forming part <strong>of</strong> the Financial Statements<br />

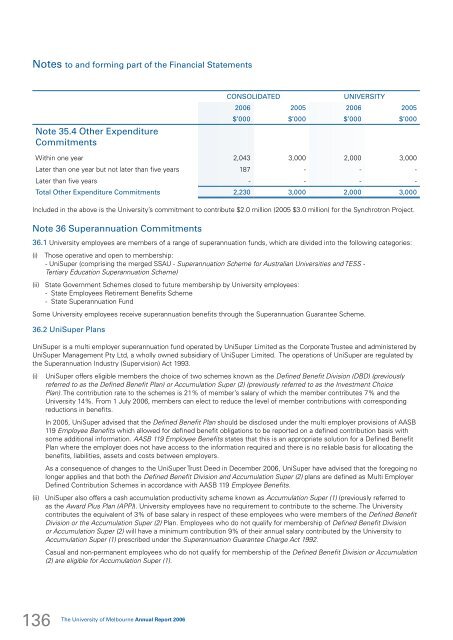

Note 35.4 Other Expenditure<br />

Commitments<br />

CONSOLIDATED<br />

UNIVERSITY<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

$’000 $’000 $’000 $’000<br />

Within one year 2,043 3,000 2,000 3,000<br />

Later than one year but not later than five years 187 - - -<br />

Later than five years - - - -<br />

Total Other Expenditure Commitments 2,230 3,000 2,000 3,000<br />

Included in the above is the <strong>University</strong>’s commitment to contribute $2.0 million (2005 $3.0 million) for the Synchrotron Project.<br />

Note 36 Superannuation Commitments<br />

36.1 <strong>University</strong> employees are members <strong>of</strong> a range <strong>of</strong> superannuation funds, which are divided into the following categories:<br />

(i) Those operative and open to membership:<br />

- UniSuper (comprising the merged SSAU - Superannuation Scheme for Australian Universities and TESS -<br />

Tertiary Education Superannuation Scheme)<br />

(ii) State Government Schemes closed to future membership by <strong>University</strong> employees:<br />

- State Employees Retirement Benefits Scheme<br />

- State Superannuation Fund<br />

Some <strong>University</strong> employees receive superannuation benefits through the Superannuation Guarantee Scheme.<br />

36.2 UniSuper Plans<br />

UniSuper is a multi employer superannuation fund operated by UniSuper Limited as the Corporate Trustee and administered by<br />

UniSuper Management Pty Ltd, a wholly owned subsidiary <strong>of</strong> UniSuper Limited. The operations <strong>of</strong> UniSuper are regulated by<br />

the Superannuation Industry (Supervision) Act 1993.<br />

(i)<br />

UniSuper <strong>of</strong>fers eligible members the choice <strong>of</strong> two schemes known as the Defined Benefit Division (DBD) (previously<br />

referred to as the Defined Benefit Plan) or Accumulation Super (2) (previously referred to as the Investment Choice<br />

Plan). The contribution rate to the schemes is 21% <strong>of</strong> member’s salary <strong>of</strong> which the member contributes 7% and the<br />

<strong>University</strong> 14%. From 1 July <strong>2006</strong>, members can elect to reduce the level <strong>of</strong> member contributions with corresponding<br />

reductions in benefits.<br />

In 2005, UniSuper advised that the Defined Benefit Plan should be disclosed under the multi employer provisions <strong>of</strong> AASB<br />

119 Employee Benefits which allowed for defined benefit obligations to be <strong>report</strong>ed on a defined contribution basis with<br />

some additional information. AASB 119 Employee Benefits states that this is an appropriate solution for a Defined Benefit<br />

Plan where the employer does not have access to the information required and there is no reliable basis for allocating the<br />

benefits, liabilities, assets and costs between employers.<br />

As a consequence <strong>of</strong> changes to the UniSuper Trust Deed in December <strong>2006</strong>, UniSuper have advised that the foregoing no<br />

longer applies and that both the Defined Benefit Division and Accumulation Super (2) plans are defined as Multi Employer<br />

Defined Contribution Schemes in accordance with AASB 119 Employee Benefits.<br />

(ii) UniSuper also <strong>of</strong>fers a cash accumulation productivity scheme known as Accumulation Super (1) (previously referred to<br />

as the Award Plus Plan (APP)). <strong>University</strong> employees have no requirement to contribute to the scheme. The <strong>University</strong><br />

contributes the equivalent <strong>of</strong> 3% <strong>of</strong> base salary in respect <strong>of</strong> these employees who were members <strong>of</strong> the Defined Benefit<br />

Division or the Accumulation Super (2) Plan. Employees who do not qualify for membership <strong>of</strong> Defined Benefit Division<br />

or Accumulation Super (2) will have a minimum contribution 9% <strong>of</strong> their <strong>annual</strong> salary contributed by the <strong>University</strong> to<br />

Accumulation Super (1) prescribed under the Superannuation Guarantee Charge Act 1992.<br />

Casual and non-permanent employees who do not qualify for membership <strong>of</strong> the Defined Benefit Division or Accumulation<br />

(2) are eligible for Accumulation Super (1).<br />

136<br />

The <strong>University</strong> <strong>of</strong> <strong>Melbourne</strong> Annual Report <strong>2006</strong>