annual report/2006 - University of Melbourne

annual report/2006 - University of Melbourne

annual report/2006 - University of Melbourne

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

financial statements/<br />

Notes to and forming part <strong>of</strong> the Financial Statements<br />

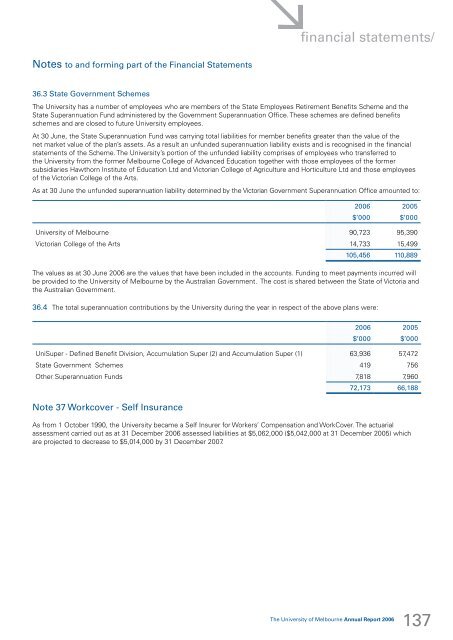

36.3 State Government Schemes<br />

The <strong>University</strong> has a number <strong>of</strong> employees who are members <strong>of</strong> the State Employees Retirement Benefits Scheme and the<br />

State Superannuation Fund administered by the Government Superannuation Office. These schemes are defined benefits<br />

schemes and are closed to future <strong>University</strong> employees.<br />

At 30 June, the State Superannuation Fund was carrying total liabilities for member benefits greater than the value <strong>of</strong> the<br />

net market value <strong>of</strong> the plan’s assets. As a result an unfunded superannuation liability exists and is recognised in the financial<br />

statements <strong>of</strong> the Scheme. The <strong>University</strong>’s portion <strong>of</strong> the unfunded liability comprises <strong>of</strong> employees who transferred to<br />

the <strong>University</strong> from the former <strong>Melbourne</strong> College <strong>of</strong> Advanced Education together with those employees <strong>of</strong> the former<br />

subsidiaries Hawthorn Institute <strong>of</strong> Education Ltd and Victorian College <strong>of</strong> Agriculture and Horticulture Ltd and those employees<br />

<strong>of</strong> the Victorian College <strong>of</strong> the Arts.<br />

As at 30 June the unfunded superannuation liability determined by the Victorian Government Superannuation Office amounted to:<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

<strong>University</strong> <strong>of</strong> <strong>Melbourne</strong> 90,723 95,390<br />

Victorian College <strong>of</strong> the Arts 14,733 15,499<br />

105,456 110,889<br />

The values as at 30 June <strong>2006</strong> are the values that have been included in the accounts. Funding to meet payments incurred will<br />

be provided to the <strong>University</strong> <strong>of</strong> <strong>Melbourne</strong> by the Australian Government. The cost is shared between the State <strong>of</strong> Victoria and<br />

the Australian Government.<br />

36.4 The total superannuation contributions by the <strong>University</strong> during the year in respect <strong>of</strong> the above plans were:<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

UniSuper - Defined Benefit Division, Accumulation Super (2) and Accumulation Super (1) 63,936 57,472<br />

State Government Schemes 419 756<br />

Other Superannuation Funds 7,818 7,960<br />

72,173 66,188<br />

Note 37 Workcover - Self Insurance<br />

As from 1 October 1990, the <strong>University</strong> became a Self Insurer for Workers’ Compensation and WorkCover. The actuarial<br />

assessment carried out as at 31 December <strong>2006</strong> assessed liabilities at $5,062,000 ($5,042,000 at 31 December 2005) which<br />

are projected to decrease to $5,014,000 by 31 December 2007.<br />

The <strong>University</strong> <strong>of</strong> <strong>Melbourne</strong> Annual Report <strong>2006</strong><br />

137