Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

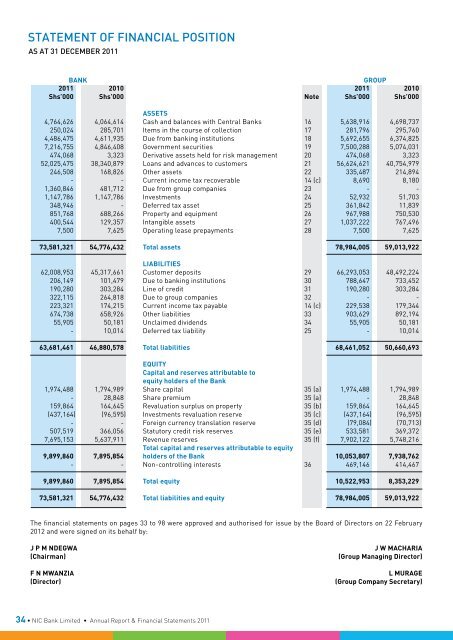

Statement Of <strong>Financial</strong> Position<br />

AS AT 31 DECEMBER <strong>2011</strong><br />

Bank<br />

Group<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Shs’000 Shs’000 Note Shs’000 Shs’000<br />

ASSETS<br />

4,764,626 4,064,614 Cash and balances with Central Banks 16 5,638,916 4,698,737<br />

250,024 285,701 Items in the course of collection 17 281,796 295,760<br />

4,486,475 4,611,935 Due from banking institutions 18 5,692,655 6,374,825<br />

7,216,755 4,846,408 Government securities 19 7,500,288 5,074,031<br />

474,068 3,323 Derivative assets held for risk management 20 474,068 3,323<br />

52,025,475 38,340,879 Loans and advances to customers 21 56,624,621 40,754,979<br />

246,508 168,826 Other assets 22 335,487 214,894<br />

- - Current income tax recoverable 14 (c) 8,690 8,180<br />

1,360,846 481,712 Due from group companies 23 - -<br />

1,147,786 1,147,786 <strong>In</strong>vestments 24 52,932 51,703<br />

348,946 - Deferred tax asset 25 361,842 11,839<br />

851,768 688,266 Property and equipment 26 967,988 750,530<br />

400,544 129,357 <strong>In</strong>tangible assets 27 1,037,222 767,496<br />

7,500 7,625 Operating lease prepayments 28 7,500 7,625<br />

73,581,321 54,776,432 Total assets 78,984,005 59,013,922<br />

LIABILITIES<br />

62,008,953 45,317,661 Customer deposits 29 66,293,053 48,492,224<br />

206,149 101,479 Due to banking institutions 30 788,647 733,452<br />

190,280 303,284 Line of credit 31 190,280 303,284<br />

322,115 264,818 Due to group companies 32 - -<br />

223,321 174,215 Current income tax payable 14 (c) 229,538 179,344<br />

674,738 658,926 Other liabilities 33 903,629 892,194<br />

55,905 50,181 Unclaimed dividends 34 55,905 50,181<br />

- 10,014 Deferred tax liability 25 - 10,014<br />

63,681,461 46,880,578 Total liabilities 68,461,052 50,660,693<br />

EQUITY<br />

Capital and reserves attributable to<br />

equity holders of the Bank<br />

1,974,488 1,794,989 Share capital 35 (a) 1,974,488 1,794,989<br />

- 28,848 Share premium 35 (a) - 28,848<br />

159,864 164,645 Revaluation surplus on property 35 (b) 159,864 164,645<br />

(437,164) (96,595) <strong>In</strong>vestments revaluation reserve 35 (c) (437,164) (96,595)<br />

- - Foreign currency translation reserve 35 (d) (79,084) (70,713)<br />

507,519 366,056 Statutory credit risk reserves 35 (e) 533,581 369,372<br />

7,695,153 5,637,911 Revenue reserves 35 (f) 7,902,122 5,748,216<br />

Total capital and reserves attributable to equity<br />

9,899,860 7,895,854 holders of the Bank 10,053,807 7,938,762<br />

- - Non-controlling interests 36 469,146 414,467<br />

9,899,860 7,895,854 Total equity 10,522,953 8,353,229<br />

73,581,321 54,776,432 Total liabilities and equity 78,984,005 59,013,922<br />

The financial statements on pages 33 to 98 were approved and authorised for issue by the Board of Directors on 22 February<br />

2012 and were signed on its behalf by:<br />

J P M NDEGWA<br />

(Chairman)<br />

F N MWANZIA<br />

(Director)<br />

J W MACHARIA<br />

(Group Managing Director)<br />

L MURAGE<br />

(Group Company Secretary)<br />

34 • NIC Bank Limited • Annual Report & <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>