Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes To The <strong>Financial</strong> <strong>Statements</strong> (Continued)<br />

As at 31 december <strong>2011</strong><br />

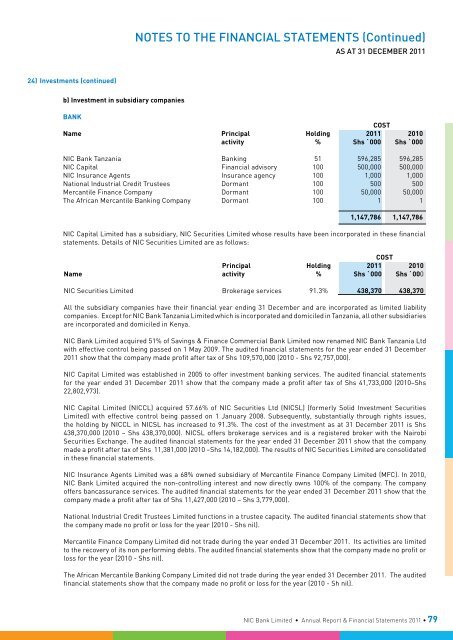

24) <strong>In</strong>vestments (continued)<br />

b) <strong>In</strong>vestment in subsidiary companies<br />

Bank<br />

Cost<br />

Name Principal Holding <strong>2011</strong> 2010<br />

activity % Shs `000 Shs `000<br />

NIC Bank Tanzania Banking 51 596,285 596,285<br />

NIC Capital <strong>Financial</strong> advisory 100 500,000 500,000<br />

NIC <strong>In</strong>surance Agents <strong>In</strong>surance agency 100 1,000 1,000<br />

National <strong>In</strong>dustrial Credit Trustees Dormant 100 500 500<br />

Mercantile Finance Company Dormant 100 50,000 50,000<br />

The <strong>Africa</strong>n Mercantile Banking Company Dormant 100 1 1<br />

1,147,786 1,147,786<br />

NIC Capital Limited has a subsidiary, NIC Securities Limited whose results have been incorporated in these financial<br />

statements. Details of NIC Securities Limited are as follows:<br />

Cost<br />

Principal Holding <strong>2011</strong> 2010<br />

Name activity % Shs `000 Shs `000<br />

NIC Securities Limited Brokerage services 91.3% 438,370 438,370<br />

All the subsidiary companies have their financial year ending 31 December and are incorporated as limited liability<br />

companies. Except for NIC Bank Tanzania Limited which is incorporated and domiciled in Tanzania, all other subsidiaries<br />

are incorporated and domiciled in Kenya.<br />

NIC Bank Limited acquired 51% of Savings & Finance Commercial Bank Limited now renamed NIC Bank Tanzania Ltd<br />

with effective control being passed on 1 May 2009. The audited financial statements for the year ended 31 December<br />

<strong>2011</strong> show that the company made profit after tax of Shs 109,570,000 (2010 - Shs 92,757,000).<br />

NIC Capital Limited was established in 2005 to offer investment banking services. The audited financial statements<br />

for the year ended 31 December <strong>2011</strong> show that the company made a profit after tax of Shs 41,733,000 (2010–Shs<br />

22,802,973).<br />

NIC Capital Limited (NICCL) acquired 57.66% of NIC Securities Ltd (NICSL) (formerly Solid <strong>In</strong>vestment Securities<br />

Limited) with effective control being passed on 1 January 2008. Subsequently, substantially through rights issues,<br />

the holding by NICCL in NICSL has increased to 91.3%. The cost of the investment as at 31 December <strong>2011</strong> is Shs<br />

438,370,000 (2010 – Shs 438,370,000). NICSL offers brokerage services and is a registered broker with the Nairobi<br />

Securities Exchange. The audited financial statements for the year ended 31 December <strong>2011</strong> show that the company<br />

made a profit after tax of Shs 11,381,000 (2010 –Shs 14,182,000). The results of NIC Securities Limited are consolidated<br />

in these financial statements.<br />

NIC <strong>In</strong>surance Agents Limited was a 68% owned subsidiary of Mercantile Finance Company Limited (MFC). <strong>In</strong> 2010,<br />

NIC Bank Limited acquired the non-controlling interest and now directly owns 100% of the company. The company<br />

offers bancassurance services. The audited financial statements for the year ended 31 December <strong>2011</strong> show that the<br />

company made a profit after tax of Shs 11,427,000 (2010 – Shs 3,779,000).<br />

National <strong>In</strong>dustrial Credit Trustees Limited functions in a trustee capacity. The audited financial statements show that<br />

the company made no profit or loss for the year (2010 - Shs nil).<br />

Mercantile Finance Company Limited did not trade during the year ended 31 December <strong>2011</strong>. Its activities are limited<br />

to the recovery of its non performing debts. The audited financial statements show that the company made no profit or<br />

loss for the year (2010 - Shs nil).<br />

The <strong>Africa</strong>n Mercantile Banking Company Limited did not trade during the year ended 31 December <strong>2011</strong>. The audited<br />

financial statements show that the company made no profit or loss for the year (2010 - Sh nil).<br />

NIC Bank Limited • Annual Report & <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> • 79