Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

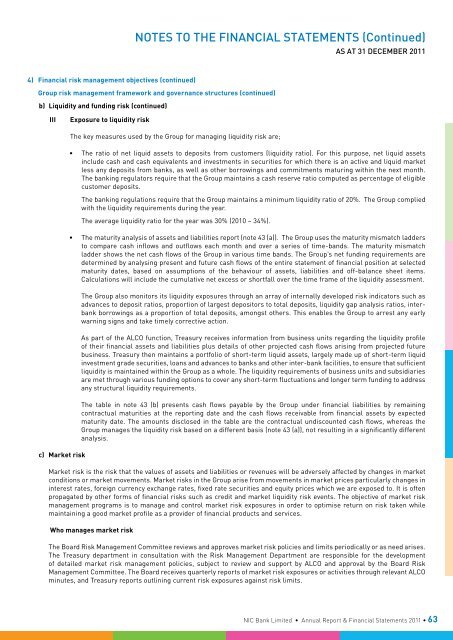

Notes To The <strong>Financial</strong> <strong>Statements</strong> (Continued)<br />

As at 31 december <strong>2011</strong><br />

4) <strong>Financial</strong> risk management objectives (continued)<br />

Group risk management framework and governance structures (continued)<br />

b) Liquidity and funding risk (continued)<br />

III<br />

Exposure to liquidity risk<br />

c) Market risk<br />

The key measures used by the Group for managing liquidity risk are;<br />

• The ratio of net liquid assets to deposits from customers (liquidity ratio). For this purpose, net liquid assets<br />

include cash and cash equivalents and investments in securities for which there is an active and liquid market<br />

less any deposits from banks, as well as other borrowings and commitments maturing within the next month.<br />

The banking regulators require that the Group maintains a cash reserve ratio computed as percentage of eligible<br />

customer deposits.<br />

The banking regulations require that the Group maintains a minimum liquidity ratio of 20%. The Group complied<br />

with the liquidity requirements during the year.<br />

The average liquidity ratio for the year was 30% (2010 – 34%).<br />

• The maturity analysis of assets and liabilities report (note 43 (a)). The Group uses the maturity mismatch ladders<br />

to compare cash inflows and outflows each month and over a series of time-bands. The maturity mismatch<br />

ladder shows the net cash flows of the Group in various time bands. The Group’s net funding requirements are<br />

determined by analysing present and future cash flows of the entire statement of financial position at selected<br />

maturity dates, based on assumptions of the behaviour of assets, liabilities and off-balance sheet items.<br />

Calculations will include the cumulative net excess or shortfall over the time frame of the liquidity assessment.<br />

The Group also monitors its liquidity exposures through an array of internally developed risk indicators such as<br />

advances to deposit ratios, proportion of largest depositors to total deposits, liquidity gap analysis ratios, interbank<br />

borrowings as a proportion of total deposits, amongst others. This enables the Group to arrest any early<br />

warning signs and take timely corrective action.<br />

As part of the ALCO function, Treasury receives information from business units regarding the liquidity profile<br />

of their financial assets and liabilities plus details of other projected cash flows arising from projected future<br />

business. Treasury then maintains a portfolio of short-term liquid assets, largely made up of short-term liquid<br />

investment grade securities, loans and advances to banks and other inter-bank facilities, to ensure that sufficient<br />

liquidity is maintained within the Group as a whole. The liquidity requirements of business units and subsidiaries<br />

are met through various funding options to cover any short-term fluctuations and longer term funding to address<br />

any structural liquidity requirements.<br />

The table in note 43 (b) presents cash flows payable by the Group under financial liabilities by remaining<br />

contractual maturities at the reporting date and the cash flows receivable from financial assets by expected<br />

maturity date. The amounts disclosed in the table are the contractual undiscounted cash flows, whereas the<br />

Group manages the liquidity risk based on a different basis (note 43 (a)), not resulting in a significantly different<br />

analysis.<br />

Market risk is the risk that the values of assets and liabilities or revenues will be adversely affected by changes in market<br />

conditions or market movements. Market risks in the Group arise from movements in market prices particularly changes in<br />

interest rates, foreign currency exchange rates, fixed rate securities and equity prices which we are exposed to. It is often<br />

propagated by other forms of financial risks such as credit and market liquidity risk events. The objective of market risk<br />

management programs is to manage and control market risk exposures in order to optimise return on risk taken while<br />

maintaining a good market profile as a provider of financial products and services.<br />

Who manages market risk<br />

The Board Risk Management Committee reviews and approves market risk policies and limits periodically or as need arises.<br />

The Treasury department in consultation with the Risk Management Department are responsible for the development<br />

of detailed market risk management policies, subject to review and support by ALCO and approval by the Board Risk<br />

Management Committee. The Board receives quarterly reports of market risk exposures or activities through relevant ALCO<br />

minutes, and Treasury reports outlining current risk exposures against risk limits.<br />

NIC Bank Limited • Annual Report & <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> • 63