Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes To The <strong>Financial</strong> <strong>Statements</strong> (Continued)<br />

As at 31 december <strong>2011</strong><br />

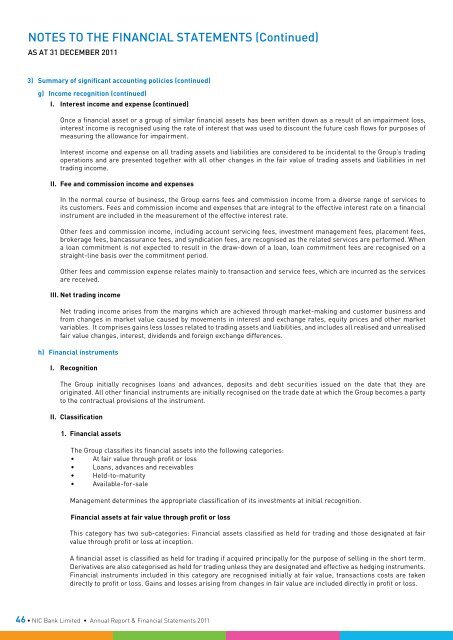

3) Summary of significant accounting policies (continued)<br />

g) <strong>In</strong>come recognition (continued)<br />

I. <strong>In</strong>terest income and expense (continued)<br />

Once a financial asset or a group of similar financial assets has been written down as a result of an impairment loss,<br />

interest income is recognised using the rate of interest that was used to discount the future cash flows for purposes of<br />

measuring the allowance for impairment.<br />

<strong>In</strong>terest income and expense on all trading assets and liabilities are considered to be incidental to the Group’s trading<br />

operations and are presented together with all other changes in the fair value of trading assets and liabilities in net<br />

trading income.<br />

II. Fee and commission income and expenses<br />

<strong>In</strong> the normal course of business, the Group earns fees and commission income from a diverse range of services to<br />

its customers. Fees and commission income and expenses that are integral to the effective interest rate on a financial<br />

instrument are included in the measurement of the effective interest rate.<br />

Other fees and commission income, including account servicing fees, investment management fees, placement fees,<br />

brokerage fees, bancassurance fees, and syndication fees, are recognised as the related services are performed. When<br />

a loan commitment is not expected to result in the draw-down of a loan, loan commitment fees are recognised on a<br />

straight-line basis over the commitment period.<br />

Other fees and commission expense relates mainly to transaction and service fees, which are incurred as the services<br />

are received.<br />

III. Net trading income<br />

Net trading income arises from the margins which are achieved through market-making and customer business and<br />

from changes in market value caused by movements in interest and exchange rates, equity prices and other market<br />

variables. It comprises gains less losses related to trading assets and liabilities, and includes all realised and unrealised<br />

fair value changes, interest, dividends and foreign exchange differences.<br />

h) <strong>Financial</strong> instruments<br />

I. Recognition<br />

The Group initially recognises loans and advances, deposits and debt securities issued on the date that they are<br />

originated. All other financial instruments are initially recognised on the trade date at which the Group becomes a party<br />

to the contractual provisions of the instrument.<br />

II. Classification<br />

1. <strong>Financial</strong> assets<br />

The Group classifies its financial assets into the following categories:<br />

• At fair value through profit or loss<br />

• Loans, advances and receivables<br />

• Held-to-maturity<br />

• Available-for-sale<br />

Management determines the appropriate classification of its investments at initial recognition.<br />

<strong>Financial</strong> assets at fair value through profit or loss<br />

This category has two sub-categories: <strong>Financial</strong> assets classified as held for trading and those designated at fair<br />

value through profit or loss at inception.<br />

A financial asset is classified as held for trading if acquired principally for the purpose of selling in the short term.<br />

Derivatives are also categorised as held for trading unless they are designated and effective as hedging instruments.<br />

<strong>Financial</strong> instruments included in this category are recognised initially at fair value, transactions costs are taken<br />

directly to profit or loss. Gains and losses arising from changes in fair value are included directly in profit or loss.<br />

46 • NIC Bank Limited • Annual Report & <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>