Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes To The <strong>Financial</strong> <strong>Statements</strong> (Continued)<br />

As at 31 december <strong>2011</strong><br />

4) <strong>Financial</strong> risk management objectives (continued)<br />

Group risk management framework and governance structures (continued)<br />

b) Liquidity and funding risk<br />

Liquidity risk is the potential for loss to an institution arising from either its inability to meet its obligations when they fall<br />

due or to fund increases in asset without incurring unacceptable costs or losses. Effective liquidity risk management is<br />

essential in order to maintain the confidence of depositors and counterparties, and to enable our core business to continue<br />

operating even under adverse liquidity circumstances.<br />

Who manages liquidity and funding risk<br />

The Assets and Liabilities Committee (ALCO), a management committee, is tasked with the responsibility of ensuring that<br />

all foreseeable funding commitments and deposits withdrawals can be met when they fall due, and that the Group will not<br />

encounter difficulties in meeting its obligations or financial liabilities as they fall due.<br />

ALCO relies substantially on the Group’s Treasury Department to coordinate and ensure discipline across the Group and<br />

business units, certify sufficient liquidity under both normal and stressed conditions, without incurring unacceptable losses<br />

or risking damage to the Group’s reputation.<br />

The Board Executive Committee has oversight over ALCOs activities through regular review of its minutes and significant<br />

reports outlining current exposures against approved risk limits. These reports are also reviewed by the Board Risk<br />

Management Committee on a quarterly basis. Liquidity policies / guidelines and limits are reviewed periodically, or as the<br />

need arises.<br />

How liquidity and funding risk is managed<br />

I<br />

Liquidity and funding management<br />

The Group’s liquidity and funding policies require that it:<br />

• Enters into lending contracts subject to availability of funds.<br />

• Projects cash flows by major currencies and consider the level of liquid assets necessary in relation<br />

thereto.<br />

• Monitors liquidity ratios against internal and regulatory requirements and guidelines.<br />

• Maintains an array of a diverse range of funding sources as back–up facilities.<br />

• Monitors depositor concentration to avoid undue reliance on large individual depositors and ensure a<br />

satisfactory funding mix.<br />

• <strong>In</strong>vests in short term liquid instruments, which can easily be sold in the market when the need arises.<br />

• Ensure investments in large cash outlay projects e.g property and equipment purchases are budgeted<br />

for and carried out only when the Group has sufficient cash flows.<br />

• Maintains liquidity and funding contingency plans. These plans and key risk indicators clearly identify<br />

early stress conditions and describe actions to be taken in the event of difficulties arising from<br />

systemic or other crisis while minimising adverse long-term implications.<br />

II<br />

Sources of funding<br />

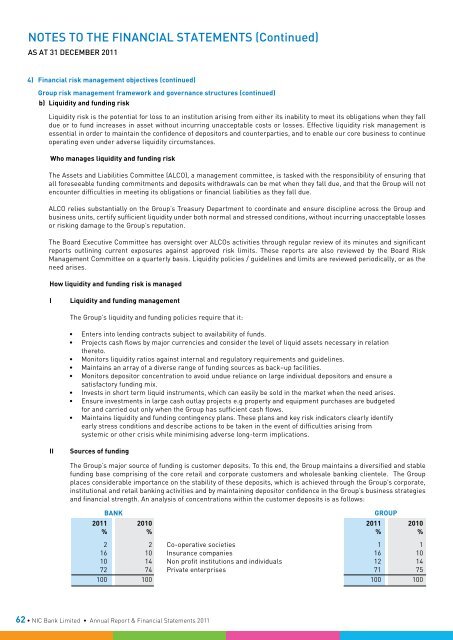

The Group’s major source of funding is customer deposits. To this end, the Group maintains a diversified and stable<br />

funding base comprising of the core retail and corporate customers and wholesale banking clientele. The Group<br />

places considerable importance on the stability of these deposits, which is achieved through the Group’s corporate,<br />

institutional and retail banking activities and by maintaining depositor confidence in the Group’s business strategies<br />

and financial strength. An analysis of concentrations within the customer deposits is as follows:<br />

Bank<br />

Group<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

% % % %<br />

2 2 Co-operative societies 1 1<br />

16 10 <strong>In</strong>surance companies 16 10<br />

10 14 Non profit institutions and individuals 12 14<br />

72 74 Private enterprises 71 75<br />

100 100 100 100<br />

62 • NIC Bank Limited • Annual Report & <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>