Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes To The <strong>Financial</strong> <strong>Statements</strong> (Continued)<br />

As at 31 december <strong>2011</strong><br />

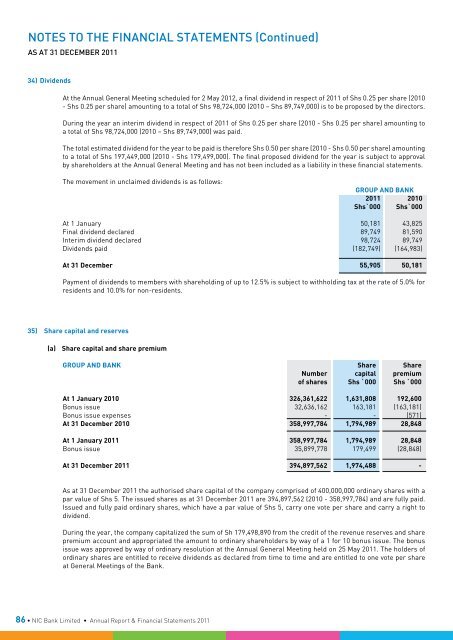

34) Dividends<br />

At the Annual General Meeting scheduled for 2 May 2012, a final dividend in respect of <strong>2011</strong> of Shs 0.25 per share (2010<br />

- Shs 0.25 per share) amounting to a total of Shs 98,724,000 (2010 – Shs 89,749,000) is to be proposed by the directors.<br />

During the year an interim dividend in respect of <strong>2011</strong> of Shs 0.25 per share (2010 - Shs 0.25 per share) amounting to<br />

a total of Shs 98,724,000 (2010 – Shs 89,749,000) was paid.<br />

The total estimated dividend for the year to be paid is therefore Shs 0.50 per share (2010 - Shs 0.50 per share) amounting<br />

to a total of Shs 197,449,000 (2010 - Shs 179,499,000). The final proposed dividend for the year is subject to approval<br />

by shareholders at the Annual General Meeting and has not been included as a liability in these financial statements.<br />

The movement in unclaimed dividends is as follows:<br />

GROUP AND BANK<br />

<strong>2011</strong> 2010<br />

Shs`000 Shs`000<br />

At 1 January 50,181 43,825<br />

Final dividend declared 89,749 81,590<br />

<strong>In</strong>terim dividend declared 98,724 89,749<br />

Dividends paid (182,749) (164,983)<br />

At 31 December 55,905 50,181<br />

Payment of dividends to members with shareholding of up to 12.5% is subject to withholding tax at the rate of 5.0% for<br />

residents and 10.0% for non-residents.<br />

35) Share capital and reserves<br />

(a) Share capital and share premium<br />

GROUP AND BANK Share Share<br />

Number capital premium<br />

of shares Shs `000 Shs `000<br />

At 1 January 2010 326,361,622 1,631,808 192,600<br />

Bonus issue 32,636,162 163,181 (163,181)<br />

Bonus issue expenses - - (571)<br />

At 31 December 2010 358,997,784 1,794,989 28,848<br />

At 1 January <strong>2011</strong> 358,997,784 1,794,989 28,848<br />

Bonus issue 35,899,778 179,499 (28,848)<br />

At 31 December <strong>2011</strong> 394,897,562 1,974,488 -<br />

As at 31 December <strong>2011</strong> the authorised share capital of the company comprised of 400,000,000 ordinary shares with a<br />

par value of Shs 5. The issued shares as at 31 December <strong>2011</strong> are 394,897,562 (2010 - 358,997,784) and are fully paid.<br />

Issued and fully paid ordinary shares, which have a par value of Shs 5, carry one vote per share and carry a right to<br />

dividend.<br />

During the year, the company capitalized the sum of Sh 179,498,890 from the credit of the revenue reserves and share<br />

premium account and appropriated the amount to ordinary shareholders by way of a 1 for 10 bonus issue. The bonus<br />

issue was approved by way of ordinary resolution at the Annual General Meeting held on 25 May <strong>2011</strong>. The holders of<br />

ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share<br />

at General Meetings of the Bank.<br />

86 • NIC Bank Limited • Annual Report & <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>