Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

Financial Statements 2011 - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes To The <strong>Financial</strong> <strong>Statements</strong> (Continued)<br />

As at 31 december <strong>2011</strong><br />

35) Share capital and reserves (continued)<br />

Premiums from the issue of shares are reported as share premiums. During the year, the share premium was fully<br />

utilised to cater for the bonus issue and related bonus issue expenses.<br />

(b) Revaluation surplus on property<br />

Revaluation reserve is made up of the periodic adjustments arising from the fair valuation of buildings, net of the<br />

related deferred taxation. The reserve is not available for distribution to the shareholders.<br />

(c)<br />

<strong>In</strong>vestments revaluation reserves<br />

This represents the unrealized increase or decrease in the fair value of available-for-sale investments, excluding<br />

impairment losses. The reserve is not available for distribution to the shareholders.<br />

(d) Foreign currency translation reserve<br />

The reserves represent exchange differences arising from translation of the net assets of the Group’s foreign operation<br />

(NIC Bank Tanzania Limited) from their functional currency (Tanzania Shillings) to the Group’s presentation currency<br />

(Kenya Shillings). These differences are recognised directly through other comprehensive income and accumulated in<br />

the foreign currency translation reserve. The Group acquired effective control of NIC Bank Tanzania Limited on 1 May<br />

2010. The reserve is not available for distribution to the shareholders.<br />

(e) Statutory credit risk reserves<br />

Where impairment losses required by prudential guidelines issued by the banking regulators exceed those computed<br />

under the <strong>In</strong>ternational <strong>Financial</strong> Reporting Standards (IFRS), the excess is recognised as a statutory reserve and<br />

accounted for as an appropriation from revenue reserves. The reserve is not available for distribution to the shareholders.<br />

(f)<br />

Revenue reserves<br />

This represents undistributed profits from current and previous years.<br />

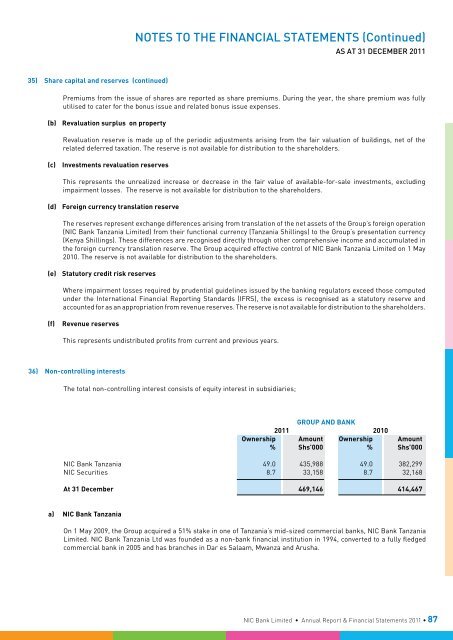

36) Non-controlling interests<br />

The total non-controlling interest consists of equity interest in subsidiaries;<br />

GROUP AND BANK<br />

<strong>2011</strong> 2010<br />

Ownership Amount Ownership Amount<br />

% Shs’000 % Shs’000<br />

NIC Bank Tanzania 49.0 435,988 49.0 382,299<br />

NIC Securities 8.7 33,158 8.7 32,168<br />

At 31 December 469,146 414,467<br />

a) NIC Bank Tanzania<br />

On 1 May 2009, the Group acquired a 51% stake in one of Tanzania’s mid-sized commercial banks, NIC Bank Tanzania<br />

Limited. NIC Bank Tanzania Ltd was founded as a non-bank financial institution in 1994, converted to a fully fledged<br />

commercial bank in 2005 and has branches in Dar es Salaam, Mwanza and Arusha.<br />

NIC Bank Limited • Annual Report & <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> • 87