Download Full Version - UMC

Download Full Version - UMC

Download Full Version - UMC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

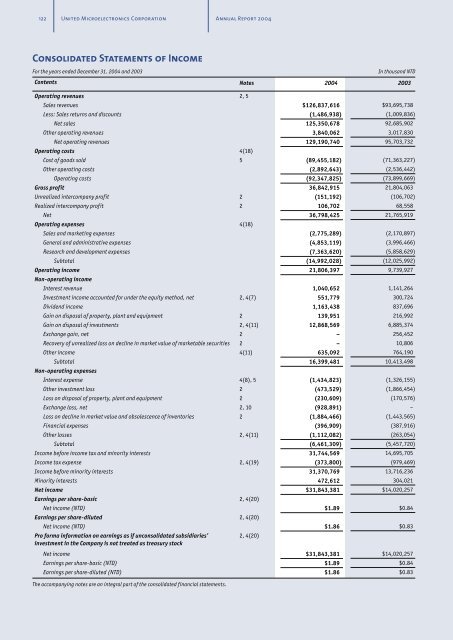

122 United Microelectronics Corporation Annual Report 2004<br />

Consolidated Statements of Income<br />

For the years ended December 31, 2004 and 2003<br />

In thousand NTD<br />

Contents Notes 2004 2003<br />

Operating revenues 2, 5<br />

Sales revenues $126,837,616 $93,695,738<br />

Less: Sales returns and discounts (1,486,938) (1,009,836)<br />

Net sales 125,350,678 92,685,902<br />

Other operating revenues 3,840,062 3,017,830<br />

Net operating revenues 129,190,740 95,703,732<br />

Operating costs 4(18)<br />

Cost of goods sold 5 (89,455,182) (71,363,227)<br />

Other operating costs (2,892,643) (2,536,442)<br />

Operating costs (92,347,825) (73,899,669)<br />

Gross profit 36,842,915 21,804,063<br />

Unrealized intercompany profit 2 (151,192) (106,702)<br />

Realized intercompany profit 2 106,702 68,558<br />

Net 36,798,425 21,765,919<br />

Operating expenses 4(18)<br />

Sales and marketing expenses (2,775,289) (2,170,897)<br />

General and administrative expenses (4,853,119) (3,996,466)<br />

Research and development expenses (7,363,620) (5,858,629)<br />

Subtotal (14,992,028) (12,025,992)<br />

Operating income 21,806,397 9,739,927<br />

Non-operating income<br />

Interest revenue 1,040,652 1,141,264<br />

Investment income accounted for under the equity method, net 2, 4(7) 551,779 300,724<br />

Dividend income 1,163,438 837,696<br />

Gain on disposal of property, plant and equipment 2 139,951 216,992<br />

Gain on disposal of investments 2, 4(11) 12,868,569 6,885,374<br />

Exchange gain, net 2 – 256,452<br />

Recovery of unrealized loss on decline in market value of marketable securities 2 – 10,806<br />

Other income 4(11) 635,092 764,190<br />

Subtotal 16,399,481 10,413,498<br />

Non-operating expenses<br />

Interest expense 4(8), 5 (1,434,823) (1,326,155)<br />

Other investment loss 2 (473,529) (1,866,454)<br />

Loss on disposal of property, plant and equipment 2 (230,609) (170,576)<br />

Exchange loss, net 2, 10 (928,891) –<br />

Loss on decline in market value and obsolescence of inventories 2 (1,884,466) (1,443,565)<br />

Financial expenses (396,909) (387,916)<br />

Other losses 2, 4(11) (1,112,082) (263,054)<br />

Subtotal (6,461,309) (5,457,720)<br />

Income before income tax and minority interests 31,744,569 14,695,705<br />

Income tax expense 2, 4(19) (373,800) (979,469)<br />

Income before minority interests 31,370,769 13,716,236<br />

Minority interests 472,612 304,021<br />

Net income $31,843,381 $14,020,257<br />

Earnings per share-basic 2, 4(20)<br />

Net income (NTD) $1.89 $0.84<br />

Earnings per share-diluted 2, 4(20)<br />

Net income (NTD) $1.86 $0.83<br />

Pro forma information on earnings as if unconsolidated subsidiaries’<br />

investment in the Company is not treated as treasury stock<br />

2, 4(20)<br />

Net income $31,843,381 $14,020,257<br />

Earnings per share-basic (NTD) $1.89 $0.84<br />

Earnings per share-diluted (NTD) $1.86 $0.83<br />

The accompanying notes are an integral part of the consolidated financial statements.