Download Full Version - UMC

Download Full Version - UMC

Download Full Version - UMC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

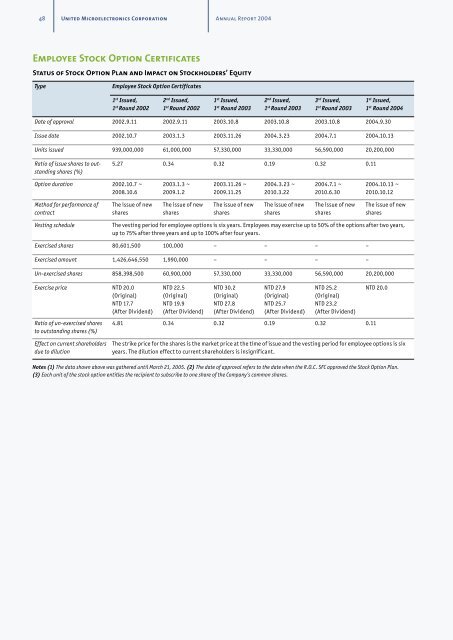

48 United Microelectronics Corporation Annual Report 2004<br />

Employee Stock Option Certificates<br />

Status of Stock Option Plan and Impact on Stockholders’ Equity<br />

Type<br />

Employee Stock Option Certificates<br />

1 st Issued,<br />

1 st Round 2002<br />

2 nd Issued,<br />

1 st Round 2002<br />

1 st Issued,<br />

1 st Round 2003<br />

2 nd Issued,<br />

1 st Round 2003<br />

3 rd Issued,<br />

1 st Round 2003<br />

1 st Issued,<br />

1 st Round 2004<br />

Date of approval 2002.9.11 2002.9.11 2003.10.8 2003.10.8 2003.10.8 2004.9.30<br />

Issue date 2002.10.7 2003.1.3 2003.11.26 2004.3.23 2004.7.1 2004.10.13<br />

Units issued 939,000,000 61,000,000 57,330,000 33,330,000 56,590,000 20,200,000<br />

Ratio of issue shares to outstanding<br />

shares (%)<br />

5.27 0.34 0.32 0.19 0.32 0.11<br />

Option duration 2002.10.7 ~<br />

2008.10.6<br />

2003.1.3 ~<br />

2009.1.2<br />

2003.11.26 ~<br />

2009.11.25<br />

2004.3.23 ~<br />

2010.3.22<br />

2004.7.1 ~<br />

2010.6.30<br />

2004.10.13 ~<br />

2010.10.12<br />

Method for performance of<br />

contract<br />

The issue of new<br />

shares<br />

The issue of new<br />

shares<br />

The issue of new<br />

shares<br />

The issue of new<br />

shares<br />

The issue of new<br />

shares<br />

The issue of new<br />

shares<br />

Vesting schedule<br />

The vesting period for employee options is six years. Employees may exercise up to 50% of the options after two years,<br />

up to 75% after three years and up to 100% after four years.<br />

Exercised shares 80,601,500 100,000 – – – –<br />

Exercised amount 1,426,646,550 1,990,000 – – – –<br />

Un-exercised shares 858,398,500 60,900,000 57,330,000 33,330,000 56,590,000 20,200,000<br />

Exercise price NTD 20.0<br />

(Original)<br />

NTD 17.7<br />

(After Dividend)<br />

Ratio of un-exercised shares<br />

to outstanding shares (%)<br />

NTD 22.5<br />

(Original)<br />

NTD 19.9<br />

(After Dividend)<br />

NTD 30.2<br />

(Original)<br />

NTD 27.8<br />

(After Dividend)<br />

NTD 27.9<br />

(Original)<br />

NTD 25.7<br />

(After Dividend)<br />

NTD 25.2<br />

(Original)<br />

NTD 23.2<br />

(After Dividend)<br />

4.81 0.34 0.32 0.19 0.32 0.11<br />

NTD 20.0<br />

Effect on current shareholders<br />

due to dilution<br />

The strike price for the shares is the market price at the time of issue and the vesting period for employee options is six<br />

years. The dilution effect to current shareholders is insignificant.<br />

Notes (1) The data shown above was gathered until March 21, 2005. (2) The date of approval refers to the date when the R.O.C. SFC approved the Stock Option Plan.<br />

(3) Each unit of the stock option entitles the recipient to subscribe to one share of the Company’s common shares.