Download Full Version - UMC

Download Full Version - UMC

Download Full Version - UMC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Corporate Overview<br />

51<br />

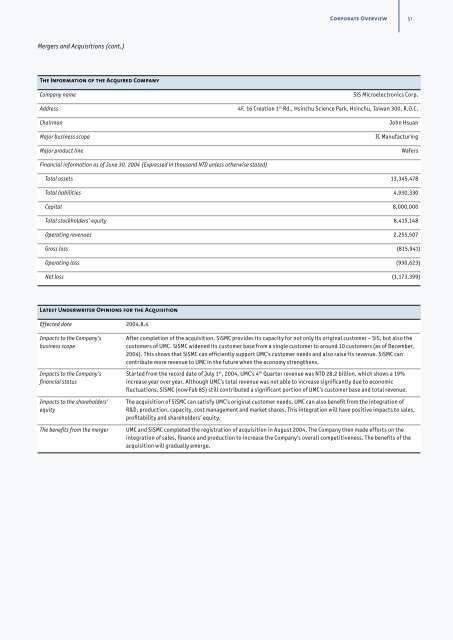

Mergers and Acquisitions (cont.)<br />

The Information of the Acquired Company<br />

Company name<br />

Address<br />

Chairman<br />

Major business scope<br />

Major product line<br />

SiS Microelectronics Corp.<br />

4F, 16 Creation 1 st Rd., Hsinchu Science Park, Hsinchu, Taiwan 300, R.O.C.<br />

John Hsuan<br />

IC Manufacturing<br />

Wafers<br />

Financial information as of June 30, 2004 (Expressed in thousand NTD unless otherwise stated)<br />

Total assets 13,345,478<br />

Total liabilities 4,930,330<br />

Capital 8,000,000<br />

Total stockholders’ equity 8,415,148<br />

Operating revenues 2,255,507<br />

Gross loss (815,941)<br />

Operating loss (930,623)<br />

Net loss (1,173,399)<br />

Latest Underwriter Opinions for the Acquisition<br />

Effected date 2004.8.4<br />

Impacts to the Company’s<br />

business scope<br />

Impacts to the Company’s<br />

financial status<br />

Impacts to the shareholders’<br />

equity<br />

The benefits from the merger<br />

After completion of the acquisition, SiSMC provides its capacity for not only its original customer – SiS, but also the<br />

customers of <strong>UMC</strong>. SiSMC widened its customer base from a single customer to around 10 customers (as of December,<br />

2004). This shows that SiSMC can efficiently support <strong>UMC</strong>’s customer needs and also raise its revenue. SiSMC can<br />

contribute more revenue to <strong>UMC</strong> in the future when the economy strengthens.<br />

Started from the record date of July 1 st , 2004, <strong>UMC</strong>’s 4 th Quarter revenue was NTD 28.2 billion, which shows a 19%<br />

increase year over year. Although <strong>UMC</strong>’s total revenue was not able to increase significantly due to economic<br />

fluctuations, SiSMC (now Fab 8S) still contributed a significant portion of <strong>UMC</strong>’s customer base and total revenue.<br />

The acquisition of SiSMC can satisfy <strong>UMC</strong>’s original customer needs. <strong>UMC</strong> can also benefit from the integration of<br />

R&D, production, capacity, cost management and market shares. This integration will have positive impacts to sales,<br />

profitability and shareholders’ equity.<br />

<strong>UMC</strong> and SiSMC completed the registration of acquisition in August 2004. The Company then made efforts on the<br />

integration of sales, finance and production to increase the Company’s overall competitiveness. The benefits of the<br />

acquisition will gradually emerge.