Download Full Version - UMC

Download Full Version - UMC

Download Full Version - UMC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Review Consolidated<br />

143<br />

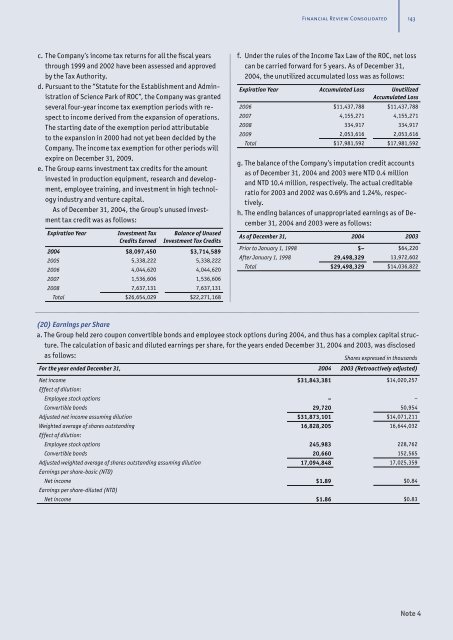

c. The Company’s income tax returns for all the fiscal years<br />

through 1999 and 2002 have been assessed and approved<br />

by the Tax Authority.<br />

d. Pursuant to the “Statute for the Establishment and Administration<br />

of Science Park of ROC”, the Company was granted<br />

several four-year income tax exemption periods with respect<br />

to income derived from the expansion of operations.<br />

The starting date of the exemption period attributable<br />

to the expansion in 2000 had not yet been decided by the<br />

Company. The income tax exemption for other periods will<br />

expire on December 31, 2009.<br />

e. The Group earns investment tax credits for the amount<br />

invested in production equipment, research and development,<br />

employee training, and investment in high technology<br />

industry and venture capital.<br />

As of December 31, 2004, the Group’s unused investment<br />

tax credit was as follows:<br />

Expiration Year<br />

Investment Tax<br />

Credits Earned<br />

Balance of Unused<br />

Investment Tax Credits<br />

2004 $8,097,450 $3,714,589<br />

2005 5,338,222 5,338,222<br />

2006 4,044,620 4,044,620<br />

2007 1,536,606 1,536,606<br />

2008 7,637,131 7,637,131<br />

Total $26,654,029 $22,271,168<br />

f. Under the rules of the Income Tax Law of the ROC, net loss<br />

can be carried forward for 5 years. As of December 31,<br />

2004, the unutilized accumulated loss was as follows:<br />

Expiration Year Accumulated Loss Unutilized<br />

Accumulated Loss<br />

2006 $11,437,788 $11,437,788<br />

2007 4,155,271 4,155,271<br />

2008 334,917 334,917<br />

2009 2,053,616 2,053,616<br />

Total $17,981,592 $17,981,592<br />

g. The balance of the Company’s imputation credit accounts<br />

as of December 31, 2004 and 2003 were NTD 0.4 million<br />

and NTD 10.4 million, respectively. The actual creditable<br />

ratio for 2003 and 2002 was 0.69% and 1.24%, respectively.<br />

h. The ending balances of unappropriated earnings as of December<br />

31, 2004 and 2003 were as follows:<br />

As of December 31, 2004 2003<br />

Prior to January 1, 1998 $– $64,220<br />

After January 1, 1998 29,498,329 13,972,602<br />

Total $29,498,329 $14,036,822<br />

(20) Earnings per Share<br />

a. The Group held zero coupon convertible bonds and employee stock options during 2004, and thus has a complex capital structure.<br />

The calculation of basic and diluted earnings per share, for the years ended December 31, 2004 and 2003, was disclosed<br />

as follows:<br />

Shares expressed in thousands<br />

For the year ended December 31, 2004 2003 (Retroactively adjusted)<br />

Net income $31,843,381 $14,020,257<br />

Effect of dilution:<br />

Employee stock options – –<br />

Convertible bonds 29,720 50,954<br />

Adjusted net income assuming dilution $31,873,101 $14,071,211<br />

Weighted average of shares outstanding 16,828,205 16,644,032<br />

Effect of dilution:<br />

Employee stock options 245,983 228,762<br />

Convertible bonds 20,660 152,565<br />

Adjusted weighted average of shares outstanding assuming dilution 17,094,848 17,025,359<br />

Earnings per share-basic (NTD)<br />

Net income $1.89 $0.84<br />

Earnings per share-diluted (NTD)<br />

Net income $1.86 $0.83<br />

Note 4