Download Full Version - UMC

Download Full Version - UMC

Download Full Version - UMC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Review Unconsolidated<br />

93<br />

(21) Merger<br />

In order to integrate resources, reduce operating costs,<br />

enlarge business scales, and improve its financial structure,<br />

profitability and global competitiveness, based on the resolution<br />

of the board of directors’ meeting on February 26,<br />

2004, the Company merged with SiSMC, the dissolved company,<br />

on July 1, 2004. The merger was approved by the relevant<br />

government authorities. All the assets, liabilities, rights,<br />

and obligations of SiSMC have been fully incorporated into<br />

the Company since July 1, 2004. The accounting treatment<br />

regarding the merger is in compliance with the ROC SFAS No.<br />

25 “Enterprise Mergers - Accounting of Purchase Method.”<br />

Relevant information required by ROC SFAS No. 25 is disclosed<br />

as follows:<br />

a. Information of the dissolved company:<br />

SiSMC was split from Silicon Integrated Systems Corp. on<br />

December 15, 2003. It was mainly engaged in manufacturing<br />

of integrated circuits and components of semiconductors.<br />

b. Effective date, percentage of acquisition and accounting<br />

treatment:<br />

Based on the agreement and the resolution of the board<br />

of directors’ meeting, the effective date of the merger<br />

was July 1, 2004. All the stocks of the dissolved company<br />

were exchanged by the surviving company’s newly issued<br />

shares, and the merger was accounted for under the purchase<br />

method.<br />

c. The period of combining the dissolved company’s operating<br />

result:<br />

The operating result for the period from July 1, 2004 to<br />

December 31, 2004 of the dissolved company was integrated<br />

into the operating result of the Company.<br />

d. Acquisition cost and the types, quantities, and amount of<br />

securities issued for the merger:<br />

According to the agreement, 357,143 thousand common<br />

shares, amounting to NTD 3,571 million, were newly issued<br />

by the Company for the merger. The newly issued shares<br />

were allocated to the dissolved company’s shareholders in<br />

proportion to their ownership. 2.24 common shares were<br />

to be exchanged for 1 new share. Since SiSMC was not a<br />

public company, there is no market value. Thus, the acquisition<br />

cost was determined based on the appraisal made by<br />

China Property Appraising Center Co., Ltd.<br />

e. Amortization method and useful lives for goodwill or deferred<br />

credit:<br />

The difference between the acquisition cost and the fair<br />

value of identifiable net assets was recognized as goodwill,<br />

which was to be amortized under the straight-line<br />

method for 15 years according to the Article 35 of Enterprise<br />

Mergers and Acquisitions Law of the ROC.<br />

f. Contingent price, warrants, or commitments and accounting<br />

treatments in the merger contracts:<br />

None.<br />

g. Decisions of disposal of significant assets from the merger:<br />

None.<br />

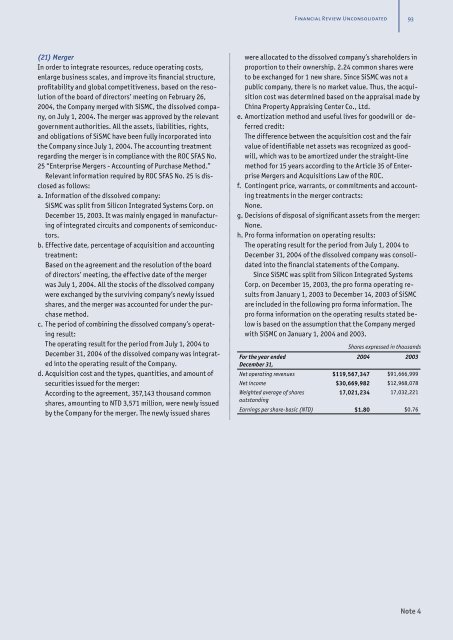

h. Pro forma information on operating results:<br />

The operating result for the period from July 1, 2004 to<br />

December 31, 2004 of the dissolved company was consolidated<br />

into the financial statements of the Company.<br />

Since SiSMC was split from Silicon Integrated Systems<br />

Corp. on December 15, 2003, the pro forma operating results<br />

from January 1, 2003 to December 14, 2003 of SiSMC<br />

are included in the following pro forma information. The<br />

pro forma information on the operating results stated below<br />

is based on the assumption that the Company merged<br />

with SiSMC on January 1, 2004 and 2003.<br />

For the year ended<br />

December 31,<br />

2004 2003<br />

Net operating revenues $119,567,347 $91,666,999<br />

Net income $30,669,982 $12,968,078<br />

Weighted average of shares<br />

outstanding<br />

Shares expressed in thousands<br />

17,021,234 17,032,221<br />

Earnings per share-basic (NTD) $1.80 $0.76<br />

Note 4