Download Full Version - UMC

Download Full Version - UMC

Download Full Version - UMC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

138 United Microelectronics Corporation Annual Report 2004<br />

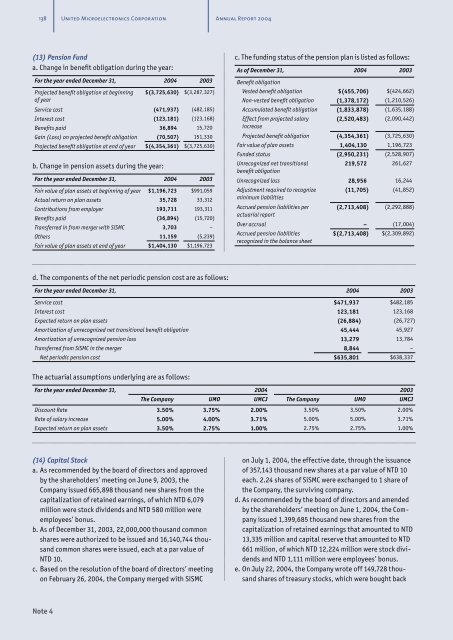

(13) Pension Fund<br />

a. Change in benefit obligation during the year:<br />

For the year ended December 31, 2004 2003<br />

Projected benefit obligation at beginning<br />

of year<br />

$(3,725,630) $(3,287,327)<br />

Service cost (471,937) (482,185)<br />

Interest cost (123,181) (123,168)<br />

Benefits paid 36,894 15,720<br />

Gain (Loss) on projected benefit obligation (70,507) 151,330<br />

Projected benefit obligation at end of year $(4,354,361) $(3,725,630)<br />

b. Change in pension assets during the year:<br />

For the year ended December 31, 2004 2003<br />

Fair value of plan assets at beginning of year $1,196,723 $991,059<br />

Actual return on plan assets 35,728 33,312<br />

Contributions from employer 193,711 193,311<br />

Benefits paid (36,894) (15,720)<br />

Transferred in from merger with SiSMC 3,703 –<br />

Others 11,159 (5,239)<br />

Fair value of plan assets at end of year $1,404,130 $1,196,723<br />

c. The funding status of the pension plan is listed as follows:<br />

As of December 31, 2004 2003<br />

Benefit obligation<br />

Vested benefit obligation $(455,706) $(424,662)<br />

Non-vested benefit obligation (1,378,172) (1,210,526)<br />

Accumulated benefit obligation (1,833,878) (1,635,188)<br />

Effect from projected salary<br />

increase<br />

(2,520,483) (2,090,442)<br />

Projected benefit obligation (4,354,361) (3,725,630)<br />

Fair value of plan assets 1,404,130 1,196,723<br />

Funded status (2,950,231) (2,528,907)<br />

Unrecognized net transitional<br />

benefit obligation<br />

219,572 261,627<br />

Unrecognized loss 28,956 16,244<br />

Adjustment required to recognize<br />

minimum liabilities<br />

Accrued pension liabilities per<br />

actuarial report<br />

(11,705) (41,852)<br />

(2,713,408) (2,292,888)<br />

Over accrual – (17,004)<br />

Accrued pension liabilities<br />

recognized in the balance sheet<br />

$(2,713,408) $(2,309,892)<br />

d. The components of the net periodic pension cost are as follows:<br />

For the year ended December 31, 2004 2003<br />

Service cost $471,937 $482,185<br />

Interest cost 123,181 123,168<br />

Expected return on plan assets (26,884) (26,727)<br />

Amortization of unrecognized net transitional benefit obligation 45,444 45,927<br />

Amortization of unrecognized pension loss 13,279 13,784<br />

Transferred from SiSMC in the merger 8,844 –<br />

Net periodic pension cost $635,801 $638,337<br />

The actuarial assumptions underlying are as follows:<br />

For the year ended December 31, 2004 2003<br />

The Company UMO <strong>UMC</strong>J The Company UMO <strong>UMC</strong>J<br />

Discount Rate 3.50% 3.75% 2.00% 3.50% 3.50% 2.00%<br />

Rate of salary increase 5.00% 4.00% 3.71% 5.00% 5.00% 3.71%<br />

Expected return on plan assets 3.50% 2.75% 1.00% 2.75% 2.75% 1.00%<br />

(14) Capital Stock<br />

a. As recommended by the board of directors and approved<br />

by the shareholders’ meeting on June 9, 2003, the<br />

Company issued 665,898 thousand new shares from the<br />

capitalization of retained earnings, of which NTD 6,079<br />

million were stock dividends and NTD 580 million were<br />

employees’ bonus.<br />

b. As of December 31, 2003, 22,000,000 thousand common<br />

shares were authorized to be issued and 16,140,744 thousand<br />

common shares were issued, each at a par value of<br />

NTD 10.<br />

c. Based on the resolution of the board of directors’ meeting<br />

on February 26, 2004, the Company merged with SiSMC<br />

on July 1, 2004, the effective date, through the issuance<br />

of 357,143 thousand new shares at a par value of NTD 10<br />

each. 2.24 shares of SiSMC were exchanged to 1 share of<br />

the Company, the surviving company.<br />

d. As recommended by the board of directors and amended<br />

by the shareholders’ meeting on June 1, 2004, the Company<br />

issued 1,399,685 thousand new shares from the<br />

capitalization of retained earnings that amounted to NTD<br />

13,335 million and capital reserve that amounted to NTD<br />

661 million, of which NTD 12,224 million were stock dividends<br />

and NTD 1,111 million were employees’ bonus.<br />

e. On July 22, 2004, the Company wrote off 149,728 thousand<br />

shares of treasury stocks, which were bought back<br />

Note 4