Download Full Version - UMC

Download Full Version - UMC

Download Full Version - UMC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

170 United Microelectronics Corporation Annual Report 2004<br />

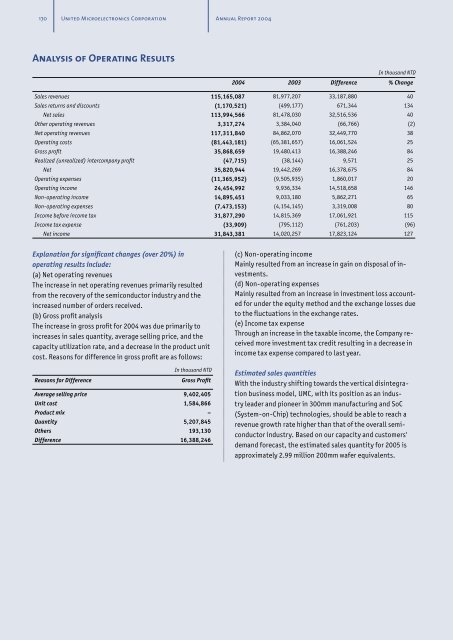

Analysis of Operating Results<br />

In thousand NTD<br />

2004 2003 Difference % Change<br />

Sales revenues 115,165,087 81,977,207 33,187,880 40<br />

Sales returns and discounts (1,170,521) (499,177) 671,344 134<br />

Net sales 113,994,566 81,478,030 32,516,536 40<br />

Other operating revenues 3,317,274 3,384,040 (66,766) (2)<br />

Net operating revenues 117,311,840 84,862,070 32,449,770 38<br />

Operating costs (81,443,181) (65,381,657) 16,061,524 25<br />

Gross profit 35,868,659 19,480,413 16,388,246 84<br />

Realized (unrealized) intercompany profit (47,715) (38,144) 9,571 25<br />

Net 35,820,944 19,442,269 16,378,675 84<br />

Operating expenses (11,365,952) (9,505,935) 1,860,017 20<br />

Operating income 24,454,992 9,936,334 14,518,658 146<br />

Non-operating income 14,895,451 9,033,180 5,862,271 65<br />

Non-operating expenses (7,473,153) (4,154,145) 3,319,008 80<br />

Income before income tax 31,877,290 14,815,369 17,061,921 115<br />

Income tax expense (33,909) (795,112) (761,203) (96)<br />

Net income 31,843,381 14,020,257 17,823,124 127<br />

Explanation for significant changes (over 20%) in<br />

operating results include:<br />

(a) Net operating revenues<br />

The increase in net operating revenues primarily resulted<br />

from the recovery of the semiconductor industry and the<br />

increased number of orders received.<br />

(b) Gross profit analysis<br />

The increase in gross profit for 2004 was due primarily to<br />

increases in sales quantity, average selling price, and the<br />

capacity utilization rate, and a decrease in the product unit<br />

cost. Reasons for difference in gross profit are as follows:<br />

Reasons for Difference<br />

In thousand NTD<br />

Gross Profit<br />

Average selling price 9,402,405<br />

Unit cost 1,584,866<br />

Product mix –<br />

Quantity 5,207,845<br />

Others 193,130<br />

Difference 16,388,246<br />

(c) Non-operating income<br />

Mainly resulted from an increase in gain on disposal of investments.<br />

(d) Non-operating expenses<br />

Mainly resulted from an increase in investment loss accounted<br />

for under the equity method and the exchange losses due<br />

to the fluctuations in the exchange rates.<br />

(e) Income tax expense<br />

Through an increase in the taxable income, the Company received<br />

more investment tax credit resulting in a decrease in<br />

income tax expense compared to last year.<br />

Estimated sales quantities<br />

With the industry shifting towards the vertical disintegration<br />

business model, <strong>UMC</strong>, with its position as an industry<br />

leader and pioneer in 300mm manufacturing and SoC<br />

(System-on-Chip) technologies, should be able to reach a<br />

revenue growth rate higher than that of the overall semiconductor<br />

industry. Based on our capacity and customers'<br />

demand forecast, the estimated sales quantity for 2005 is<br />

approximately 2.99 million 200mm wafer equivalents.