Year 2007

Year 2007

Year 2007

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Debtors, overdue under 3 months, for premium due and uncollected represented 81.7 percent of the net premium. Most<br />

of them, however, were within a grace period offered by the Company. For the portion expected to be a bad debt, the Company<br />

had provided an allowance for doubtful accounts, which was deemed adequate for the risk of being unable to collect these debts.<br />

Simultaneously, the Company also increased channels for debt payment to provide convenience to its customers, agents and<br />

brokers in their payment to the Company in due time. Meanwhile, the Company had enhanced its efficiencies in the premium<br />

collections and debt follow-up to reduce the number of premium debtors to an acceptable level.<br />

<br />

Loans <br />

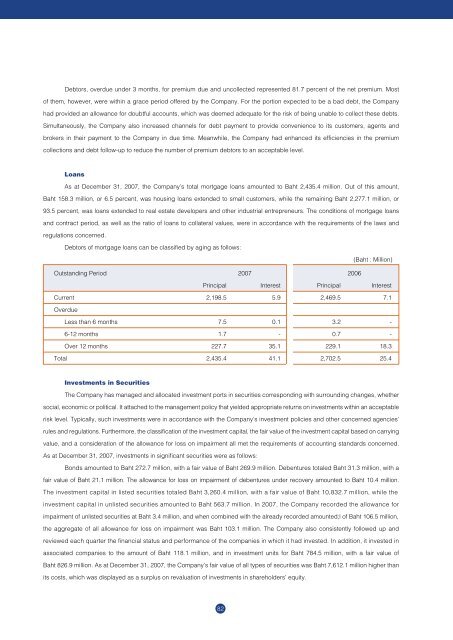

As at December 31, <strong>2007</strong>, the Company’s total mortgage loans amounted to Baht 2,435.4 million. Out of this amount,<br />

Baht 158.3 million, or 6.5 percent, was housing loans extended to small customers, while the remaining Baht 2,277.1 million, or<br />

93.5 percent, was loans extended to real estate developers and other industrial entrepreneurs. The conditions of mortgage loans<br />

and contract period, as well as the ratio of loans to collateral values, were in accordance with the requirements of the laws and<br />

regulations concerned.<br />

Debtors of mortgage loans can be classified by aging as follows:<br />

(Baht : Million)<br />

Outstanding Period <strong>2007</strong> 2006<br />

Principal Interest Principal Interest<br />

Current 2,198.5 5.9 2,469.5 7.1<br />

Overdue<br />

Less than 6 months 7.5 0.1 3.2 -<br />

6-12 months 1.7 - 0.7 -<br />

Over 12 months 227.7 35.1 229.1 18.3<br />

Total 2,435.4 41.1 2,702.5 25.4<br />

<br />

Investments in Securities<br />

The Company has managed and allocated investment ports in securities corresponding with surrounding changes, whether<br />

social, economic or political. It attached to the management policy that yielded appropriate returns on investments within an acceptable<br />

risk level. Typically, such investments were in accordance with the Company’s investment policies and other concerned agencies’<br />

rules and regulations. Furthermore, the classification of the investment capital, the fair value of the investment capital based on carrying<br />

value, and a consideration of the allowance for loss on impairment all met the requirements of accounting standards concerned.<br />

As at December 31, <strong>2007</strong>, investments in significant securities were as follows:<br />

Bonds amounted to Baht 272.7 million, with a fair value of Baht 269.9 million. Debentures totaled Baht 31.3 million, with a<br />

fair value of Baht 21.1 million. The allowance for loss on impairment of debentures under recovery amounted to Baht 10.4 million.<br />

The investment capital in listed securities totaled Baht 3,260.4 million, with a fair value of Baht 10,832.7 million, while the<br />

investment capital in unlisted securities amounted to Baht 563.7 million. In <strong>2007</strong>, the Company recorded the allowance for<br />

impairment of unlisted securities at Baht 3.4 million, and when combined with the already recorded amounted;l of Baht 106.5 million,<br />

the aggregate of all allowance for loss on impairment was Baht 103.1 million. The Company also consistently followed up and<br />

reviewed each quarter the financial status and performance of the companies in which it had invested. In addition, it invested in<br />

associated companies to the amount of Baht 118.1 million, and in investment units for Baht 784.5 million, with a fair value of<br />

Baht 826.9 million. As at December 31, <strong>2007</strong>, the Company’s fair value of all types of securities was Baht 7,612.1 million higher than<br />

its costs, which was displayed as a surplus on revaluation of investments in shareholders’ equity.<br />

<br />

82