Year 2007

Year 2007

Year 2007

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

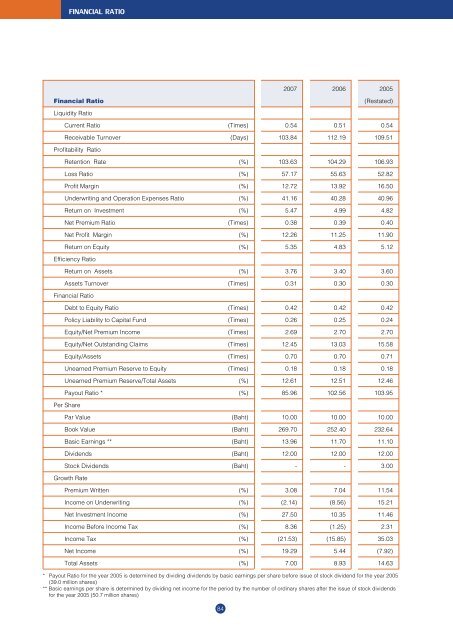

FINANCIAL RATIO<br />

<strong>2007</strong> 2006 2005<br />

Financial Ratio<br />

(Restated)<br />

Liquidity Ratio<br />

Current Ratio (Times) 0.54 0.51 0.54<br />

Receivable Turnover (Days) 103.84 112.19 109.51<br />

Profitability Ratio<br />

Retention Rate (%) 103.63 104.29 106.93<br />

Loss Ratio (%) 57.17 55.63 52.82<br />

Profit Margin (%) 12.72 13.92 16.50<br />

Underwriting and Operation Expenses Ratio (%) 41.16 40.28 40.96<br />

Return on Investment (%) 5.47 4.99 4.82<br />

Net Premium Ratio (Times) 0.38 0.39 0.40<br />

Net Profit Margin (%) 12.26 11.25 11.90<br />

Return on Equity (%) 5.35 4.83 5.12<br />

Efficiency Ratio<br />

Return on Assets (%) 3.76 3.40 3.60<br />

Assets Turnover (Times) 0.31 0.30 0.30<br />

Financial Ratio<br />

Debt to Equity Ratio (Times) 0.42 0.42 0.42<br />

Policy Liability to Capital Fund (Times) 0.26 0.25 0.24<br />

Equity/Net Premium Income (Times) 2.69 2.70 2.70<br />

Equity/Net Outstanding Claims (Times) 12.45 13.03 15.58<br />

Equity/Assets (Times) 0.70 0.70 0.71<br />

Unearned Premium Reserve to Equity (Times) 0.18 0.18 0.18<br />

Unearned Premium Reserve/Total Assets (%) 12.61 12.51 12.46<br />

Payout Ratio * (%) 85.96 102.56 103.95<br />

Per Share<br />

Par Value (Baht) 10.00 10.00 10.00<br />

Book Value (Baht) 269.70 252.40 232.64<br />

Basic Earnings ** (Baht) 13.96 11.70 11.10<br />

Dividends (Baht) 12.00 12.00 12.00<br />

Stock Dividends (Baht) - - 3.00<br />

Growth Rate<br />

Premium Written (%) 3.08 7.04 11.54<br />

Income on Underwriting (%) (2.14) (8.56) 15.21<br />

Net Investment Income (%) 27.50 10.35 11.46<br />

Income Before Income Tax (%) 8.36 (1.25) 2.31<br />

Income Tax (%) (21.53) (15.85) 35.03<br />

Net Income (%) 19.29 5.44 (7.92)<br />

Total Assets (%) 7.00 8.93 14.63<br />

* Payout Ratio for the year 2005 is determined by dividing dividends by basic earnings per share before issue of stock dividend for the year 2005<br />

(39.0 million shares)<br />

** Basic earnings per share is determined by dividing net income for the period by the number of ordinary shares after the issue of stock dividends<br />

for the year 2005 (50.7 million shares)<br />

84