Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the consolidated financial statements<br />

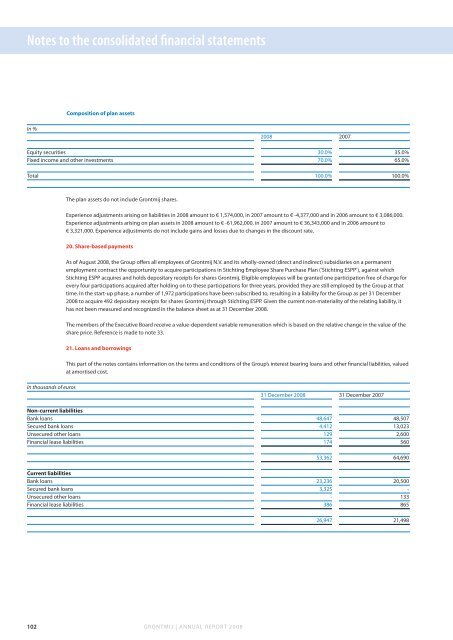

Composition of plan assets<br />

In %<br />

<strong>2008</strong> 2007<br />

Equity securities 30.0% 35.0%<br />

Fixed income and other investments 70.0% 65.0%<br />

Total 100.0% 100.0%<br />

The plan assets do not include <strong>Grontmij</strong> shares.<br />

Experience adjustments arising on liabilities in <strong>2008</strong> amount to € 1,574,000, in 2007 amount to € -4,377,000 and in 2006 amount to € 3,086,000.<br />

Experience adjustments arising on plan assets in <strong>2008</strong> amount to € -61,962,000, in 2007 amount to € 36,343,000 and in 2006 amount to<br />

€ 3,321,000. Experience adjustments do not include gains and losses due to changes in the discount rate.<br />

20. Share-based payments<br />

As of August <strong>2008</strong>, the Group offers all employees of <strong>Grontmij</strong> N.V. and its wholly-owned (direct and indirect) subsidiaries on a permanent<br />

employment contract the opportunity to acquire participations in Stichting Employee Share Purchase Plan (‘Stichting ESPP’), against which<br />

Stichting ESPP acquires and holds depositary receipts for shares <strong>Grontmij</strong>. Eligible employees will be granted one participation free of charge for<br />

every four participations acquired after holding on to these participations for three years, provided they are still employed by the Group at that<br />

time. In the start-up phase, a number of 1,972 participations have been subscribed to, resulting in a liability for the Group as per 31 December<br />

<strong>2008</strong> to acquire 492 depositary receipts for shares <strong>Grontmij</strong> through Stichting ESPP. Given the current non-materiality of the relating liability, it<br />

has not been measured and recognized in the balance sheet as at 31 December <strong>2008</strong>.<br />

The members of the Executive Board receive a value-dependent variable remuneration which is based on the relative change in the value of the<br />

share price. Reference is made to note 33.<br />

21. Loans and borrowings<br />

This part of the notes contains information on the terms and conditions of the Group’s interest bearing loans and other financial liabilities, valued<br />

at amortised cost.<br />

In thousands of euros<br />

31 December <strong>2008</strong> 31 December 2007<br />

Non-current liabilities<br />

Bank loans 48,647 48,507<br />

Secured bank loans 4,412 13,023<br />

Unsecured other loans 129 2,600<br />

Financial lease liabilities 174 560<br />

53,362 64,690<br />

Current liabilities<br />

Bank loans 23,236 20,500<br />

Secured bank loans 3,325 -<br />

Unsecured other loans - 133<br />

Financial lease liabilities 386 865<br />

26,947 21,498<br />

102<br />

GRONTMIJ | ANNUAL REPORT <strong>2008</strong>