Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

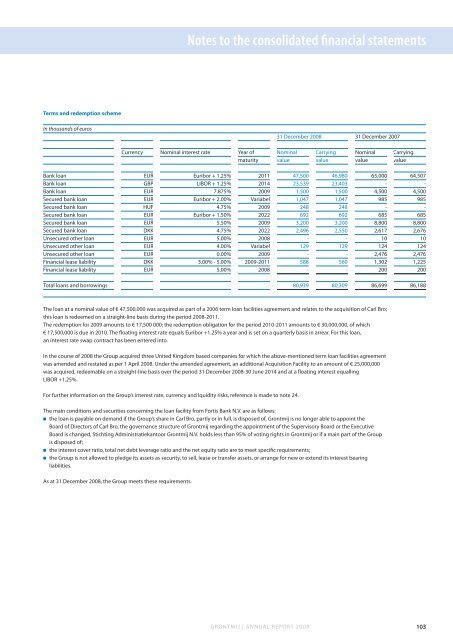

Notes to the consolidated financial statements<br />

Terms and redemption scheme<br />

In thousands of euros<br />

31 December <strong>2008</strong> 31 December 2007<br />

Currency Nominal interest rate Year of Nominal Carrying Nominal Carrying<br />

maturity value value value value<br />

Bank loan EUR Euribor + 1.25% 2011 47,500 46,980 65,000 64,507<br />

Bank loan GBP LIBOR + 1.25% 2014 23,539 23,403 - -<br />

Bank loan EUR 7.875% 2009 1,500 1,500 4,500 4,500<br />

Secured bank loan EUR Euribor + 2.00% Variabel 1,047 1,047 985 985<br />

Secured bank loan HUF 4.75% 2009 248 248 - -<br />

Secured bank loan EUR Euribor + 1.50% 2022 692 692 685 685<br />

Secured bank loan EUR 5.50% 2009 3,200 3,200 8,800 8,800<br />

Secured bank loan DKK 4.75% 2022 2,496 2,550 2,617 2,676<br />

Unsecured other loan EUR 5.00% <strong>2008</strong> - - 10 10<br />

Unsecured other loan EUR 4.00% Variabel 129 129 124 124<br />

Unsecured other loan EUR 0.00% 2009 - - 2,476 2,476<br />

Financial lease liability DKK 3.00% - 5.00% 2009-2011 588 560 1,302 1,225<br />

Financial lease liability EUR 5.00% <strong>2008</strong> - - 200 200<br />

Total loans and borrowings 80,939 80,309 86,699 86,188<br />

The loan at a nominal value of € 47,500,000 was acquired as part of a 2006 term loan facilities agreement and relates to the acquisition of Carl Bro;<br />

this loan is redeemed on a straight-line basis during the period <strong>2008</strong>-2011.<br />

The redemption for 2009 amounts to € 17,500 000; the redemption obligation for the period 2010-2011 amounts to € 30,000,000, of which<br />

€ 17,500,000 is due in 2010. The floating interest rate equals Euribor +1.25% a year and is set on a quarterly basis in arrear. For this loan,<br />

an interest rate swap contract has been entered into.<br />

In the course of <strong>2008</strong> the Group acquired three United Kingdom based companies for which the above-mentioned term loan facilities agreement<br />

was amended and restated as per 1 April <strong>2008</strong>. Under the amended agreement, an additional Acquisition Facility to an amount of € 25,000,000<br />

was acquired, redeemable on a straight-line basis over the period 31 December <strong>2008</strong>-30 June 2014 and at a floating interest equalling<br />

LIBOR +1.25%.<br />

For further information on the Group’s interest rate, currency and lquidity risks, reference is made to note 24.<br />

The main conditions and securities concerning the loan facility from Fortis Bank N.V. are as follows:<br />

o the loan is payable on demand if the Group’s share in Carl Bro, partly or in full, is disposed of, <strong>Grontmij</strong> is no longer able to appoint the<br />

Board of Directors of Carl Bro, the governance structure of <strong>Grontmij</strong> regarding the appointment of the Supervisory Board or the Executive<br />

Board is changed, Stichting Administratiekantoor <strong>Grontmij</strong> N.V. holds less than 95% of voting rights in <strong>Grontmij</strong> or if a main part of the Group<br />

is disposed of;<br />

o the interest cover ratio, total net debt leverage ratio and the net equity ratio are to meet specific requirements;<br />

o the Group is not allowed to pledge its assets as security, to sell, lease or transfer assets, or arrange for new or extend its interest bearing<br />

liabilities.<br />

As at 31 December <strong>2008</strong>, the Group meets these requirements.<br />

GRONTMIJ | ANNUAL REPORT <strong>2008</strong> 103