Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

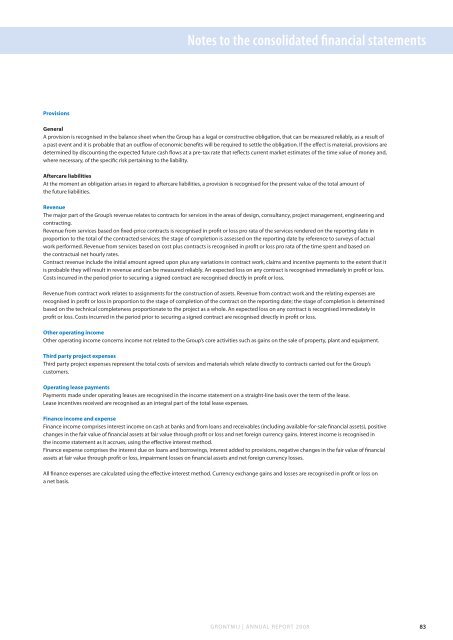

Notes to the consolidated financial statements<br />

Provisions<br />

General<br />

A provision is recognised in the balance sheet when the Group has a legal or constructive obligation, that can be measured reliably, as a result of<br />

a past event and it is probable that an outflow of economic benefits will be required to settle the obligation. If the effect is material, provisions are<br />

determined by discounting the expected future cash flows at a pre-tax rate that reflects current market estimates of the time value of money and,<br />

where necessary, of the specific risk pertaining to the liability.<br />

Aftercare liabilities<br />

At the moment an obligation arises in regard to aftercare liabilities, a provision is recognised for the present value of the total amount of<br />

the future liabilities.<br />

Revenue<br />

The major part of the Group’s revenue relates to contracts for services in the areas of <strong>design</strong>, consultancy, project management, <strong>engineering</strong> and<br />

contracting.<br />

Revenue from services based on fixed-price contracts is recognised in profit or loss pro rata of the services rendered on the reporting date in<br />

proportion to the total of the contracted services; the stage of completion is assessed on the reporting date by reference to surveys of actual<br />

work performed. Revenue from services based on cost plus contracts is recognised in profit or loss pro rata of the time spent and based on<br />

the contractual net hourly rates.<br />

Contract revenue include the initial amount agreed upon plus any variations in contract work, claims and incentive payments to the extent that it<br />

is probable they will result in revenue and can be measured reliably. An expected loss on any contract is recognised immediately in profit or loss.<br />

Costs incurred in the period prior to securing a signed contract are recognised directly in profit or loss.<br />

Revenue from contract work relates to assignments for the construction of assets. Revenue from contract work and the relating expenses are<br />

recognised in profit or loss in proportion to the stage of completion of the contract on the reporting date; the stage of completion is determined<br />

based on the technical completeness proportionate to the project as a whole. An expected loss on any contract is recognised immediately in<br />

profit or loss. Costs incurred in the period prior to securing a signed contract are recognised directly in profit or loss.<br />

Other operating income<br />

Other operating income concerns income not related to the Group’s core activities such as gains on the sale of property, plant and equipment.<br />

Third party project expenses<br />

Third party project expenses represent the total costs of services and materials which relate directly to contracts carried out for the Group’s<br />

customers.<br />

Operating lease payments<br />

Payments made under operating leases are recognised in the income statement on a straight-line basis over the term of the lease.<br />

Lease incentives received are recognised as an integral part of the total lease expenses.<br />

Finance income and expense<br />

Finance income comprises interest income on cash at banks and from loans and receivables (including available-for-sale financial assets), positive<br />

changes in the fair value of financial assets at fair value through profit or loss and net foreign currency gains. Interest income is recognised in<br />

the income statement as it accrues, using the effective interest method.<br />

Finance expense comprises the interest due on loans and borrowings, interest added to provisions, negative changes in the fair value of financial<br />

assets at fair value through profit or loss, impairment losses on financial assets and net foreign currency losses.<br />

All finance expenses are calculated using the effective interest method. Currency exchange gains and losses are recognised in profit or loss on<br />

a net basis.<br />

GRONTMIJ | ANNUAL REPORT <strong>2008</strong> 83