Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

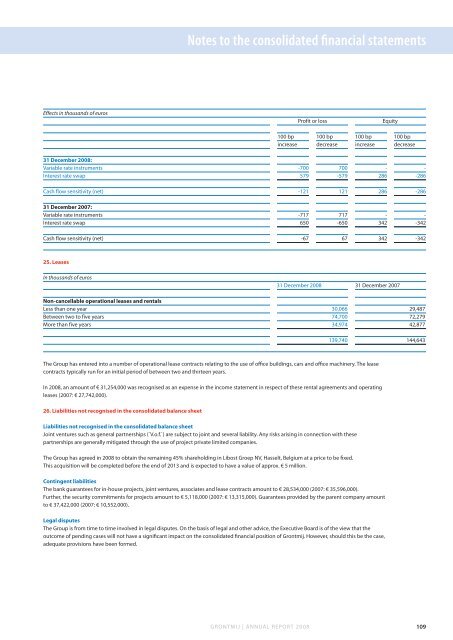

Notes to the consolidated financial statements<br />

Effects in thousands of euros<br />

Profit or loss<br />

Equity<br />

100 bp 100 bp 100 bp 100 bp<br />

increase decrease increase decrease<br />

31 December <strong>2008</strong>:<br />

Variable rate instruments -700 700 - -<br />

Interest rate swap 579 -579 286 -286<br />

Cash flow sensitivity (net) -121 121 286 -286<br />

31 December 2007:<br />

Variable rate instruments -717 717 - -<br />

Interest rate swap 650 -650 342 -342<br />

Cash flow sensitivity (net) -67 67 342 -342<br />

25. Leases<br />

In thousands of euros<br />

31 December <strong>2008</strong> 31 December 2007<br />

Non-cancellable operational leases and rentals<br />

Less than one year 30,066 29,487<br />

Between two to five years 74,700 72,279<br />

More than five years 34,974 42,877<br />

139,740 144,643<br />

The Group has entered into a number of operational lease contracts relating to the use of office buildings, cars and office machinery. The lease<br />

contracts typically run for an initial period of between two and thirteen years.<br />

In <strong>2008</strong>, an amount of € 31,254,000 was recognised as an expense in the income statement in respect of these rental agreements and operating<br />

leases (2007: € 27,742,000).<br />

26. Liabilities not recognised in the consolidated balance sheet<br />

Liabilities not recognised in the consolidated balance sheet<br />

Joint ventures such as general partnerships (`V.o.f.`) are subject to joint and several liability. Any risks arising in connection with these<br />

partnerships are generally mitigated through the use of project private limited companies.<br />

The Group has agreed in <strong>2008</strong> to obtain the remaining 45% shareholding in Libost Groep NV, Hasselt, Belgium at a price to be fixed.<br />

This acquisition will be completed before the end of 2013 and is expected to have a value of approx. € 5 million.<br />

Contingent liabilities<br />

The bank guarantees for in-house projects, joint ventures, associates and lease contracts amount to € 28,534,000 (2007: € 35,596,000).<br />

Further, the security commitments for projects amount to € 5,118,000 (2007: € 13,315,000). Guarantees provided by the parent company amount<br />

to € 37,422,000 (2007: € 10,552,000).<br />

Legal disputes<br />

The Group is from time to time involved in legal disputes. On the basis of legal and other advice, the Executive Board is of the view that the<br />

outcome of pending cases will not have a significant impact on the consolidated financial position of <strong>Grontmij</strong>. However, should this be the case,<br />

adequate provisions have been formed.<br />

GRONTMIJ | ANNUAL REPORT <strong>2008</strong> 109