Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the consolidated financial statements<br />

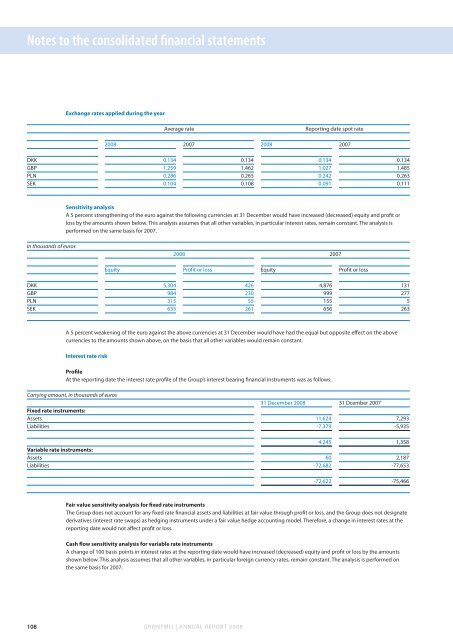

Exchange rates applied during the year<br />

Average rate<br />

<strong>Report</strong>ing date spot rate<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007<br />

DKK 0.134 0.134 0.134 0.134<br />

GBP 1.259 1.462 1.027 1.485<br />

PLN 0.286 0.265 0.242 0.263<br />

SEK 0.104 0.108 0.091 0.111<br />

Sensitivity analysis<br />

A 5 percent strengthening of the euro against the following currencies at 31 December would have increased (decreased) equity and profit or<br />

loss by the amounts shown below. This analysis assumes that all other variables, in particular interest rates, remain constant. The analysis is<br />

performed on the same basis for 2007.<br />

In thousands of euros<br />

<strong>2008</strong> 2007<br />

Equity Profit or loss Equity Profit or loss<br />

DKK 5,304 426 4,876 131<br />

GBP 984 230 999 277<br />

PLN 315 55 155 5<br />

SEK 635 261 656 263<br />

A 5 percent weakening of the euro against the above currencies at 31 December would have had the equal but opposite effect on the above<br />

currencies to the amounts shown above, on the basis that all other variables would remain constant.<br />

Interest rate risk<br />

Profile<br />

At the reporting date the interest rate profile of the Group’s interest bearing financial instruments was as follows:<br />

Carrying amount, in thousands of euros<br />

31 December <strong>2008</strong> 31 Dcember 2007<br />

Fixed rate instruments:<br />

Assets 11,624 7,293<br />

Liabilities -7,379 -5,935<br />

4,245 1,358<br />

Variable rate instruments:<br />

Assets 60 2,187<br />

Liabilities -72,682 -77,653<br />

-72,622 -75,466<br />

Fair value sensitivity analysis for fixed rate instruments<br />

The Group does not account for any fixed rate financial assets and liabilities at fair value through profit or loss, and the Group does not <strong>design</strong>ate<br />

derivatives (interest rate swaps) as hedging instruments under a fair value hedge accounting model. Therefore, a change in interest rates at the<br />

reporting date would not affect profit or loss.<br />

Cash flow sensitivity analysis for variable rate instruments<br />

A change of 100 basis points in interest rates at the reporting date would have increased (decreased) equity and profit or loss by the amounts<br />

shown below. This analysis assumes that all other variables, in particular foreign currency rates, remain constant. The analysis is performed on<br />

the same basis for 2007.<br />

108<br />

GRONTMIJ | ANNUAL REPORT <strong>2008</strong>