Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Annual Report 2008 Sustainable design & engineering - Grontmij

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Information for shareholders<br />

During <strong>2008</strong>, a new employee share-ownership scheme was introduced. The new scheme is <strong>design</strong>ed for all <strong>Grontmij</strong> employees<br />

with the exception of the members of the Executive Board. So far, the scheme has been rolled out in the Netherlands, the United<br />

Kingdom, Ireland and Poland. Under the new scheme and based on a resolution of the Executive Board, employees may, up to a<br />

certain percentage of their fixed income, invest in the company through Stichting Employee Share Purchase Plan. The employee<br />

acquires participations in Stichting Employee Share Purchase Plan, which in turn buys a corresponding number of depositary<br />

receipts in <strong>Grontmij</strong> N.V. on Euronext Amsterdam. The participations are issued at a discount of 15% of the underlying market<br />

value of the depositary receipts. Participations must be retained for a period of three years. After this period, each employee<br />

receives one additional participation for every four participations he or she holds. Matching participations and their corresponding<br />

initial participations must be held for a further two years before they can be sold. As in the other plan, the employee incurs no<br />

transaction or custody fees. At the end of <strong>2008</strong>, 32 members of staff were registered for 1,973 participations.<br />

The maximum amount that may be invested through these schemes is set at 5% of the issued share capital of <strong>Grontmij</strong> N.V.<br />

There are no options schemes available at <strong>Grontmij</strong>.<br />

EQUITY INTERESTS<br />

Based on information publicly available as of 31 December <strong>2008</strong> and/or information provided by major shareholders,<br />

the following shareholders have an interest of more than 5% in the share capital of <strong>Grontmij</strong>:<br />

Delta Deelnemingen Fonds 10.6%<br />

Parcom Quoted Equity Management BV 6.3%<br />

Capital Research and Management Company 5.2%*<br />

Aviva plc 5.1%<br />

Optiverder B.V. 5.1%<br />

* Voting rights on these shares are held by Smallcap World Fund Inc.<br />

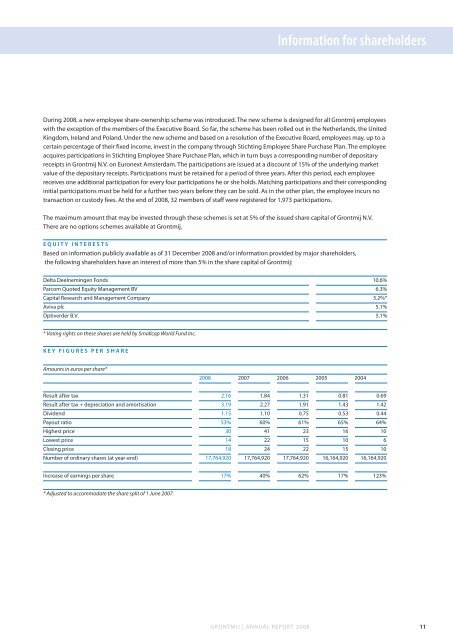

KEY FIGURES PER SHARE<br />

Amounts in euros per share*<br />

<strong>2008</strong> 2007 2006 2005 2004<br />

Result after tax 2.16 1.84 1.31 0.81 0.69<br />

Result after tax + depreciation and amortisation 3.19 2.27 1.91 1.43 1.42<br />

Dividend 1.15 1.10 0.75 0.53 0.44<br />

Payout ratio 53% 60% 61% 65% 64%<br />

Highest price 30 41 23 16 10<br />

Lowest price 14 22 15 10 6<br />

Closing price 18 24 22 15 10<br />

Number of ordinary shares (at year-end) 17,764,920 17,764,920 17,764,920 16,164,920 16,164,920<br />

Increase of earnings per share 17% 40% 62% 17% 123%<br />

* Adjusted to accommodate the share split of 1 June 2007.<br />

GRONTMIJ | ANNUAL REPORT <strong>2008</strong><br />

11