3 - SNHU Academic Archive

3 - SNHU Academic Archive

3 - SNHU Academic Archive

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

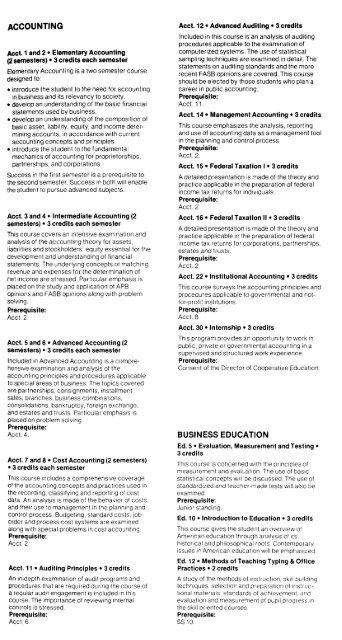

ACCOUNTING<br />

Acct. 1 and 2 • Elementary Accounting<br />

(2 semesters) • 3 credits each semester<br />

Elementary Accounting is a two semester course<br />

designed to:<br />

• introduce the student to the need for accounting<br />

in business and its relevancy to society.<br />

• develop an understanding of the basic financial<br />

statements used by business.<br />

• develop an understanding of the composition of<br />

basic asset, liability, equity, and income determining<br />

accounts, in accordance with current<br />

accounting concepts and principles.<br />

• introduce the student to the fundamental<br />

mechanics of accounting for proprietorships,<br />

partnerships, and corporations.<br />

Success in the first semester is a prerequisite to<br />

the second semester. Success in both will enable<br />

the student to pursue advanced subjects.<br />

Acct. 3 and 4 • Intermediate Accounting (2<br />

semesters) • 3 credits each semester<br />

This course covers an intensive examination and<br />

analysis of the accounting theory for assets,<br />

liabilities and stockholders' equity essential for the<br />

development and understanding of financial<br />

statements, The underlying concepts of matching<br />

revenue and expenses for the determination of<br />

net income are stressed. Particular emphasis is<br />

placed on the study and application of APB<br />

opinions and FASB opinions along with problem<br />

solving,<br />

Prerequisite:<br />

Acct. 2.<br />

Acct. 5 and 6 • Advanced Accounting (2<br />

semesters) • 3 credits each semester<br />

Included in Advanced Accounting is a comprehensive<br />

examination and analysis of the<br />

accounting principles and procedures applicable<br />

to special areas of business. The topics covered<br />

are partnerships, consignments, installment<br />

sales, branches, business combinations,<br />

consolidations, bankruptcy, foreign exchange,<br />

and estates and trusts. Particular emphasis is<br />

placed on problem solving.<br />

Prerequisite:<br />

Acct. 4.<br />

Acct, 7 and 8 • Cost Accounting (2 semesters)<br />

• 3 credits each semester<br />

This course includes a comprehensive coverage<br />

of the accounting concepts and practices used in<br />

the recording, classifying and reporting of cost<br />

data, An analysis is made of the behavior of costs,<br />

and their use to management in the planning and<br />

control process. Budgeting, standard costs, job<br />

order and process cost systems are examined<br />

along with special problems in cost accounting.<br />

Prerequisite:<br />

Acct. 2.<br />

Acct. 11 • Auditing Principles • 3 credits<br />

An in-depth examination of audit programs and<br />

procedures that are required during the course of<br />

a regular audit engagement is included in this<br />

course. The importance of reviewing internal<br />

controls is stressed.<br />

Prerequisite:<br />

Acct 6<br />

Acct. 12 • Advanced Auditing • 3 credits<br />

Included in this course is an analysis of auditing<br />

procedures applicable to the examination of<br />

computerized systems. The use of statistical<br />

sampling techniques are examined in detail. The<br />

statements on auditing standards and the more<br />

recent FASB opinions are covered. This course<br />

should be elected by those students who plan a<br />

career in public accounting.<br />

Prerequisite:<br />

Acct. 11.<br />

Acct. 14 • Management Accounting • 3 credits<br />

This course emphasizes the analysis, reporting<br />

and use of accounting data as a management tool<br />

in the planning and control process.<br />

Prerequisite:<br />

Acct. 2.<br />

Acct. 15 • Federal Taxation I • 3 credits<br />

A detailed presentation is made of the theory and<br />

practice applicable in the preparation of federal<br />

income tax returns for individuals.<br />

Prerequisite:<br />

Acct. 2.<br />

Acct. 16 • Federal Taxation II • 3 credits<br />

A detailed presentation is made of the theory and<br />

practice applicable in the preparation of federal<br />

income tax returns for corporations, partnerships,<br />

estates and trusts.<br />

Prerequisite:<br />

Acct. 2.<br />

Acct. 22 • Institutional Accounting • 3 credits<br />

This course surveys the accounting principles and<br />

procedures applicable to governmental and notfor-profit<br />

institutions.<br />

Prerequisite:<br />

Acct. 8.<br />

Acct. 30 • Internship • 3 credits<br />

This program provides an opportunity to work in<br />

public, private or governmental accounting in a<br />

supervised and structured work experience.<br />

Prerequisite:<br />

Consent of the Director of Cooperative Education.<br />

BUSINESS EDUCATION<br />

Ed. 5 • Evaluation, Measurement and Testing •<br />

3 credits<br />

This course is concerned with the principles of<br />

measurement and evaluation. The use of basic<br />

statistical concepts will be discussed. The use of<br />

standardized and teacher-made tests will also be<br />

examined.<br />

Prerequisite:<br />

Junior standing.<br />

Ed, 10 • Introduction to Education • 3 credits<br />

This course gives the student an overview of<br />

American education through analysis of its<br />

historical and philosophical roots. Contemporary<br />

issues in American education will be emphasized,<br />

Ed. 12 • Methods of Teaching Typing & Office<br />

Practices • 2 credits<br />

A study of the methods of instruction, skill building<br />

techniques, selection and preparation of instructional<br />

materials, standards of achievement, and<br />

evaluation and measurement of pupil progress in<br />

the skill oriented courses.<br />

Prerequisite:<br />

SS10