Journal of Tourism and Services - Vysoká škola obchodnà v Praze

Journal of Tourism and Services - Vysoká škola obchodnà v Praze

Journal of Tourism and Services - Vysoká škola obchodnà v Praze

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

We tested significance <strong>of</strong> relationships between businesses’ perception<br />

<strong>of</strong> certain tax system`s aspects (administrative severity, total tax rate <strong>and</strong><br />

clarity <strong>of</strong> tax calculations) <strong>and</strong> businesses` underst<strong>and</strong>ing <strong>of</strong> tax reform.<br />

In the tax reform applied in 2004 were implemented changes clarifying<br />

the administrative processes (constant marginal tax rate applied on<br />

individual <strong>and</strong> corporate income tax as well as on Value Added Tax). On<br />

the other h<strong>and</strong> this measure expose to the change <strong>of</strong> catering <strong>and</strong><br />

hospitality services` VAT rate, which has become on the st<strong>and</strong>ard level<br />

instead <strong>of</strong> reduced.<br />

Based on results <strong>of</strong> used statistical methods we are not able to prove<br />

that underst<strong>and</strong>ing <strong>of</strong> tax reform influences the fact how businesses<br />

perceive the tax system`s administrative severity On the other h<strong>and</strong>,<br />

business underst<strong>and</strong>ing flat tax positive are more likely to evaluate the<br />

clarity <strong>of</strong> tax calculation to be high (Table 5).<br />

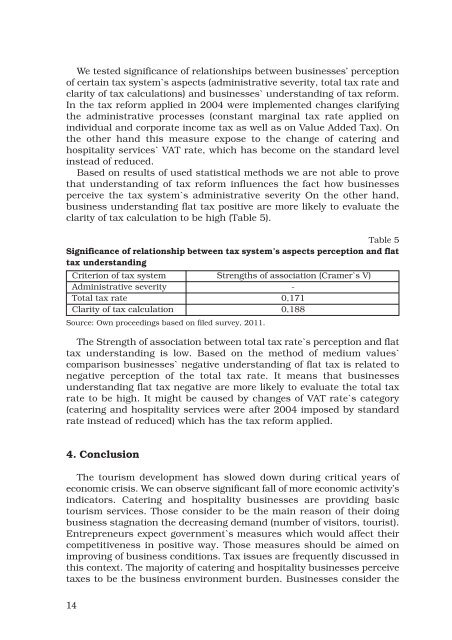

Table 5<br />

Significance <strong>of</strong> relationship between tax system’s aspects perception <strong>and</strong> flat<br />

tax underst<strong>and</strong>ing<br />

Criterion <strong>of</strong> tax system Strengths <strong>of</strong> association (Cramer`s V)<br />

Administrative severity -<br />

Total tax rate 0,171<br />

Clarity <strong>of</strong> tax calculation 0,188<br />

Source: Own proceedings based on filed survey, 2011.<br />

The Strength <strong>of</strong> association between total tax rate`s perception <strong>and</strong> flat<br />

tax underst<strong>and</strong>ing is low. Based on the method <strong>of</strong> medium values`<br />

comparison businesses` negative underst<strong>and</strong>ing <strong>of</strong> flat tax is related to<br />

negative perception <strong>of</strong> the total tax rate. It means that businesses<br />

underst<strong>and</strong>ing flat tax negative are more likely to evaluate the total tax<br />

rate to be high. It might be caused by changes <strong>of</strong> VAT rate`s category<br />

(catering <strong>and</strong> hospitality services were after 2004 imposed by st<strong>and</strong>ard<br />

rate instead <strong>of</strong> reduced) which has the tax reform applied.<br />

4. Conclusion<br />

The tourism development has slowed down during critical years <strong>of</strong><br />

economic crisis. We can observe significant fall <strong>of</strong> more economic activity’s<br />

indicators. Catering <strong>and</strong> hospitality businesses are providing basic<br />

tourism services. Those consider to be the main reason <strong>of</strong> their doing<br />

business stagnation the decreasing dem<strong>and</strong> (number <strong>of</strong> visitors, tourist).<br />

Entrepreneurs expect government`s measures which would affect their<br />

competitiveness in positive way. Those measures should be aimed on<br />

improving <strong>of</strong> business conditions. Tax issues are frequently discussed in<br />

this context. The majority <strong>of</strong> catering <strong>and</strong> hospitality businesses perceive<br />

taxes to be the business environment burden. Businesses consider the<br />

14