Annual Report 2010 - ProCredit Bank

Annual Report 2010 - ProCredit Bank

Annual Report 2010 - ProCredit Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements 59<br />

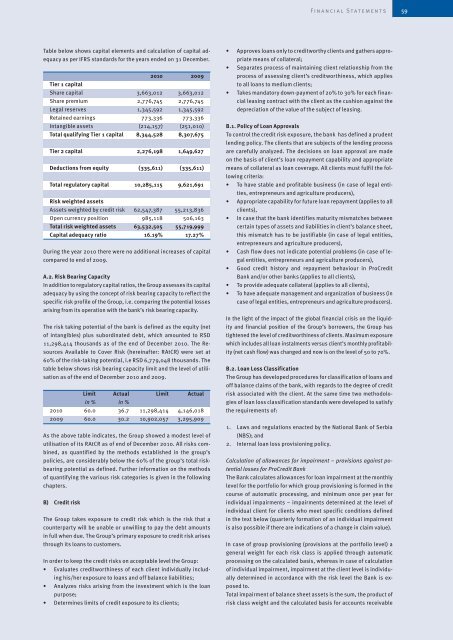

Table below shows capital elements and calculation of capital adequacy<br />

as per IFRS standards for the years ended on 31 December.<br />

Tier 1 capital<br />

<strong>2010</strong> 2009<br />

Share capital 3,663,012 3,663,012<br />

Share premium 2,776,745 2,776,745<br />

Legal reserves 1,345,592 1,345,592<br />

Retained earnings 773,336 773,336<br />

Intangible assets (214,157) (251,010)<br />

Total qualifying Tier 1 capital 8,344,528 8,307,675<br />

Tier 2 capital 2,276,198 1,649,627<br />

Deductions from equity (335,611) (335,611)<br />

Total regulatory capital 10,285,115 9,621,691<br />

Risk weighted assets<br />

Assets weighted by credit risk 62,547,387 55,213,836<br />

Open currency position 985,118 506,163<br />

Total risk weighted assets 63,532,505 55,719,999<br />

Capital adequacy ratio 16.19% 17.27%<br />

During the year <strong>2010</strong> there were no additional increases of capital<br />

compared to end of 2009.<br />

A.2. Risk Bearing Capacity<br />

In addition to regulatory capital ratios, the Group assesses its capital<br />

adequacy by using the concept of risk bearing capacity to reflect the<br />

specific risk profile of the Group, i.e. comparing the potential losses<br />

arising from its operation with the bank’s risk bearing capacity.<br />

The risk taking potential of the bank is defined as the equity (net<br />

of intangibles) plus subordinated debt, which amounted to RSD<br />

11,298,414 thousands as of the end of December <strong>2010</strong>. The Resources<br />

Available to Cover Risk (hereinafter: RAtCR) were set at<br />

60% of the risk-taking potential, i.e RSD 6,779,048 thousands. The<br />

table below shows risk bearing capacity limit and the level of utilisation<br />

as of the end of December <strong>2010</strong> and 2009.<br />

Limit Actual Limit Actual<br />

in % in %<br />

<strong>2010</strong> 60.0 36.7 11,298,414 4,146,018<br />

2009 60.0 30.2 10,902,057 3,295,909<br />

As the above table indicates, the Group showed a modest level of<br />

utilisation of its RAtCR as of end of December <strong>2010</strong>. All risks combined,<br />

as quantified by the methods established in the group’s<br />

policies, are considerably below the 60% of the group’s total riskbearing<br />

potential as defined. Further information on the methods<br />

of quantifying the various risk categories is given in the following<br />

chapters.<br />

B) Credit risk<br />

The Group takes exposure to credit risk which is the risk that a<br />

counterparty will be unable or unwilling to pay the debt amounts<br />

in full when due. The Group’s primary exposure to credit risk arises<br />

through its loans to customers.<br />

In order to keep the credit risks on acceptable level the Group:<br />

• Evaluates creditworthiness of each client individually including<br />

his/her exposure to loans and off balance liabilities;<br />

• Analyzes risks arising from the investment which is the loan<br />

purpose;<br />

• Determines limits of credit exposure to its clients;<br />

• Approves loans only to creditworthy clients and gathers appropriate<br />

means of collateral;<br />

• Separates process of maintaining client relationship from the<br />

process of assessing client’s creditworthiness, which applies<br />

to all loans to medium clients;<br />

• Takes mandatory down-payment of 20% to 30% for each financial<br />

leasing contract with the client as the cushion against the<br />

depreciation of the value of the subject of leasing.<br />

B.1. Policy of Loan Approvals<br />

To control the credit risk exposure, the bank has defined a prudent<br />

lending policy. The clients that are subjects of the lending process<br />

are carefully analyzed. The decisions on loan approval are made<br />

on the basis of client’s loan repayment capability and appropriate<br />

means of collateral as loan coverage. All clients must fulfil the following<br />

criteria:<br />

• To have stable and profitable business (in case of legal entities,<br />

entrepreneurs and agriculture producers),<br />

• Appropriate capability for future loan repayment (applies to all<br />

clients),<br />

• In case that the bank identifies maturity mismatches between<br />

certain types of assets and liabilities in client’s balance sheet,<br />

this mismatch has to be justifiable (in case of legal entities,<br />

entrepreneurs and agriculture producers),<br />

• Cash flow does not indicate potential problems (in case of legal<br />

entities, entrepreneurs and agriculture producers),<br />

• Good credit history and repayment behaviour in <strong>ProCredit</strong><br />

<strong>Bank</strong> and/or other banks (applies to all clients),<br />

• To provide adequate collateral (applies to all clients),<br />

• To have adequate management and organization of business (in<br />

case of legal entities, entrepreneurs and agriculture producers).<br />

In the light of the impact of the global financial crisis on the liquidity<br />

and financial position of the Group’s borrowers, the Group has<br />

tightened the level of creditworthiness of clients. Maximum exposure<br />

which includes all loan instalments versus client’s monthly profitability<br />

(net cash flow) was changed and now is on the level of 50 to 70%.<br />

B.2. Loan Loss Classification<br />

The Group has developed procedures for classification of loans and<br />

off balance claims of the bank, with regards to the degree of credit<br />

risk associated with the client. At the same time two methodologies<br />

of loan loss classification standards were developed to satisfy<br />

the requirements of:<br />

1. Laws and regulations enacted by the National <strong>Bank</strong> of Serbia<br />

(NBS); and<br />

2. Internal loan loss provisioning policy.<br />

Calculation of allowances for impairment – provisions against potential<br />

losses for <strong>ProCredit</strong> <strong>Bank</strong><br />

The <strong>Bank</strong> calculates allowances for loan impairment at the monthly<br />

level for the portfolio for which group provisioning is formed in the<br />

course of automatic processing, and minimum once per year for<br />

individual impairments – impairments determined at the level of<br />

individual client for clients who meet specific conditions defined<br />

in the text below (quarterly formation of an individual impairment<br />

is also possible if there are indications of a change in claim value).<br />

In case of group provisioning (provisions at the portfolio level) a<br />

general weight for each risk class is applied through automatic<br />

processing on the calculated basis, whereas in case of calculation<br />

of individual impairment, impairment at the client level is individually<br />

determined in accordance with the risk level the <strong>Bank</strong> is exposed<br />

to.<br />

Total impairment of balance sheet assets is the sum, the product of<br />

risk class weight and the calculated basis for accounts receivable