Annual Report 2010 - ProCredit Bank

Annual Report 2010 - ProCredit Bank

Annual Report 2010 - ProCredit Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

78<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

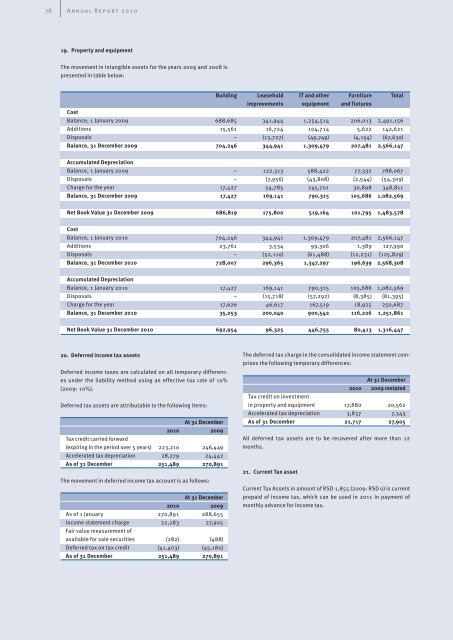

19. Property and equipment<br />

The movement in intangible assets for the years 2009 and 2008 is<br />

presented in table below:<br />

Building Leasehold IT and other Furniture Total<br />

improvements equipment and fixtures<br />

Cost<br />

Balance, 1 January 2009 688,685 341,944 1,254,514 206,013 2,491,156<br />

Additions 15,561 16,724 104,714 5,622 142,621<br />

Disposals – (13,727) (49,749) (4,154) (67,630)<br />

Balance, 31 December 2009 704,246 344,941 1,309,479 207,481 2,566,147<br />

Accumulated Depreciation<br />

Balance, 1 January 2009 – 122,313 588,422 77,332 788,067<br />

Disposals – (7,956) (43,808) (2,544) (54,309)<br />

Charge for the year 17,427 54,785 245,701 30,898 348,811<br />

Balance, 31 December 2009 17,427 169,141 790,315 105,686 1,082,569<br />

Net Book Value 31 December 2009 686,819 175,800 519,164 101,795 1,483,578<br />

Cost<br />

Balance, 1 January <strong>2010</strong> 704,246 344,941 1,309,479 207,481 2,566,147<br />

Additions 23,761 3,534 99,306 1,389 127,990<br />

Disposals – (52,110) (61,488) (12,231) (125,829)<br />

Balance, 31 December <strong>2010</strong> 728,007 296,365 1,347,297 196,639 2,568,308<br />

Accumulated Depreciation<br />

Balance, 1 January <strong>2010</strong> 17,427 169,141 790,315 105,686 1,082,569<br />

Disposals – (15,718) (57,292) (8,385) (81,395)<br />

Charge for the year 17,626 46,617 167,519 18,925 250,687<br />

Balance, 31 December <strong>2010</strong> 35,053 200,040 900,542 116,226 1,251,861<br />

Net Book Value 31 December <strong>2010</strong> 692,954 96,325 446,755 80,413 1,316,447<br />

20. Deferred income tax assets<br />

Deferred income taxes are calculated on all temporary differences<br />

under the liability method using an effective tax rate of 10%<br />

(2009: 10%).<br />

Deferred tax assets are attributable to the following items:<br />

At 31 December<br />

<strong>2010</strong> 2009<br />

Tax credit carried forward<br />

(expiring in the period over 5 years) 223,210 246,449<br />

Accelerated tax depreciation 28,279 24,442<br />

As of 31 December 251,489 270,891<br />

The movement in deferred income tax account is as follows:<br />

At 31 December<br />

<strong>2010</strong> 2009<br />

As of 1 January 270,891 288,655<br />

Income statement charge 22,283 27,905<br />

Fair value measurement of<br />

available for sale securities (282) (488)<br />

Deferred tax on tax credit (41,403) (45,180)<br />

As of 31 December 251,489 270,891<br />

The deferred tax charge in the consolidated income statement comprises<br />

the following temporary differences:<br />

At 31 December<br />

<strong>2010</strong> 2009 restated<br />

Tax credit on investment<br />

in property and equipment 17,880 20,562<br />

Accelerated tax depreciation 3,837 7,343<br />

As of 31 December 21,717 27,905<br />

All deferred tax assets are to be recovered after more than 12<br />

months.<br />

21. Current Tax asset<br />

Current Tax Assets in amount of RSD 1,855 (2009: RSD 0) is current<br />

prepaid of income tax, which can be used in 2011 in payment of<br />

monthly advance for income tax.