MYOB Manual - Time Billing

MYOB Manual - Time Billing

MYOB Manual - Time Billing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

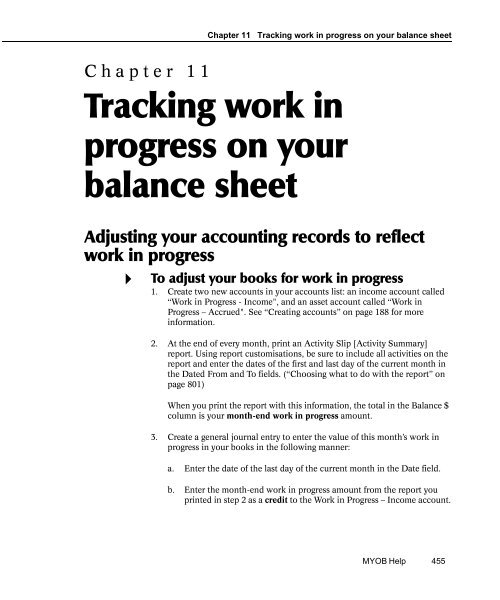

Chapter 11 Tracking work in progress on your balance sheet<br />

Chapter 11<br />

Tracking work in<br />

progress on your<br />

balance sheet<br />

Adjusting your accounting records to reflect<br />

work in progress<br />

4<br />

To adjust your books for work in progress<br />

1. Create two new accounts in your accounts list: an income account called<br />

“Work in Progress - Income", and an asset account called “Work in<br />

Progress — Accrued". See “Creating accounts” on page 188 for more<br />

information.<br />

2. At the end of every month, print an Activity Slip [Activity Summary]<br />

report. Using report customisations, be sure to include all activities on the<br />

report and enter the dates of the first and last day of the current month in<br />

the Dated From and To fields. (“Choosing what to do with the report” on<br />

page 801)<br />

When you print the report with this information, the total in the Balance $<br />

column is your month-end work in progress amount.<br />

3. Create a general journal entry to enter the value of this month’s work in<br />

progress in your books in the following manner:<br />

a. Enter the date of the last day of the current month in the Date field.<br />

b. Enter the month-end work in progress amount from the report you<br />

printed in step 2 as a credit to the Work in Progress — Income account.<br />

<strong>MYOB</strong> Help 455