2010-11 - Grasim

2010-11 - Grasim

2010-11 - Grasim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

UltraTec<br />

ech Cement Limited<br />

SCHEDULE 21 (Contd.)<br />

B. Notes on Accounts<br />

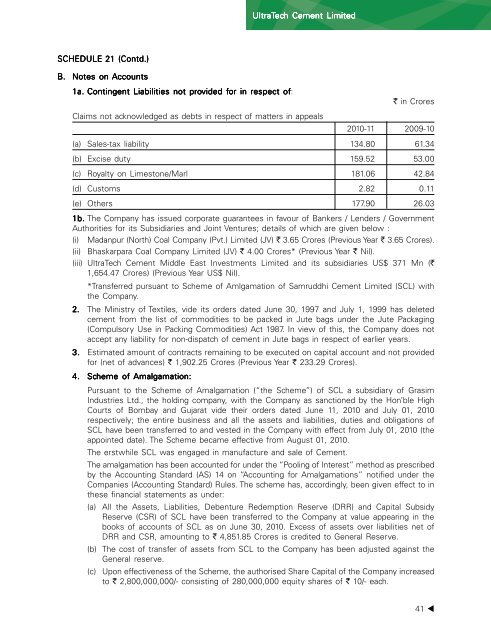

1a. Contingent Liabilities not provided for in respect of:<br />

Claims not acknowledged as debts in respect of matters in appeals<br />

` in Crores<br />

<strong>2010</strong>-<strong>11</strong> 2009-10<br />

(a) Sales-tax liability 134.80 61.34<br />

(b) Excise duty 159.52 53.00<br />

(c) Royalty on Limestone/Marl 181.06 42.84<br />

(d) Customs 2.82 0.<strong>11</strong><br />

(e) Others 177.90 26.03<br />

1b. The Company has issued corporate guarantees in favour of Bankers / Lenders / Government<br />

Authorities for its Subsidiaries and Joint Ventures; details of which are given below :<br />

(i) Madanpur (North) Coal Company (Pvt.) Limited (JV) ` 3.65 Crores (Previous Year ` 3.65 Crores).<br />

(ii) Bhaskarpara Coal Company Limited (JV) ` 4.00 Crores* (Previous Year ` Nil).<br />

(iii) UltraTech Cement Middle East Investments Limited and its subsidiaries US$ 371 Mn (`<br />

1,654.47 Crores) (Previous Year US$ Nil).<br />

*Transferred pursuant to Scheme of Amlgamation of Samruddhi Cement Limited (SCL) with<br />

the Company.<br />

2. The Ministry of Textiles, vide its orders dated June 30, 1997 and July 1, 1999 has deleted<br />

cement from the list of commodities to be packed in Jute bags under the Jute Packaging<br />

(Compulsory Use in Packing Commodities) Act 1987. In view of this, the Company does not<br />

accept any liability for non-dispatch of cement in Jute bags in respect of earlier years.<br />

3. Estimated amount of contracts remaining to be executed on capital account and not provided<br />

for (net of advances) ` 1,902.25 Crores (Previous Year ` 233.29 Crores).<br />

4. Scheme of Amalgamation:<br />

Pursuant to the Scheme of Amalgamation (“the Scheme”) of SCL a subsidiary of <strong>Grasim</strong><br />

Industries Ltd., the holding company, with the Company as sanctioned by the Hon’ble High<br />

Courts of Bombay and Gujarat vide their orders dated June <strong>11</strong>, <strong>2010</strong> and July 01, <strong>2010</strong><br />

respectively; the entire business and all the assets and liabilities, duties and obligations of<br />

SCL have been transferred to and vested in the Company with effect from July 01, <strong>2010</strong> (the<br />

appointed date). The Scheme became effective from August 01, <strong>2010</strong>.<br />

The erstwhile SCL was engaged in manufacture and sale of Cement.<br />

The amalgamation has been accounted for under the “Pooling of Interest” method as prescribed<br />

by the Accounting Standard (AS) 14 on “Accounting for Amalgamations” notified under the<br />

Companies (Accounting Standard) Rules. The scheme has, accordingly, been given effect to in<br />

these financial statements as under:<br />

(a) All the Assets, Liabilities, Debenture Redemption Reserve (DRR) and Capital Subsidy<br />

Reserve (CSR) of SCL have been transferred to the Company at value appearing in the<br />

books of accounts of SCL as on June 30, <strong>2010</strong>. Excess of assets over liabilities net of<br />

DRR and CSR, amounting to ` 4,851.85 Crores is credited to General Reserve.<br />

(b) The cost of transfer of assets from SCL to the Company has been adjusted against the<br />

General reserve.<br />

(c) Upon effectiveness of the Scheme, the authorised Share Capital of the Company increased<br />

to ` 2,800,000,000/- consisting of 280,000,000 equity shares of ` 10/- each.<br />

41 ⊳