Shefrin - Behavioral & Neoclassical asset pricing theories - 2008

Shefrin - Behavioral & Neoclassical asset pricing theories - 2008

Shefrin - Behavioral & Neoclassical asset pricing theories - 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

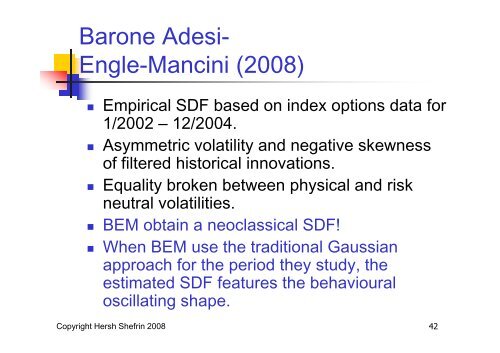

Barone Adesi-<br />

Engle-Mancini (<strong>2008</strong>)<br />

<br />

<br />

<br />

<br />

<br />

Empirical SDF based on index options data for<br />

1/2002 – 12/2004.<br />

Asymmetric volatility and negative skewness<br />

of filtered historical innovations.<br />

Equality broken between physical and risk<br />

neutral volatilities.<br />

BEM obtain a neoclassical SDF!<br />

When BEM use the traditional Gaussian<br />

approach for the period they study, the<br />

estimated SDF features the behavioural<br />

oscillating shape.<br />

Copyright Hersh <strong>Shefrin</strong> <strong>2008</strong><br />

42