Shefrin - Behavioral & Neoclassical asset pricing theories - 2008

Shefrin - Behavioral & Neoclassical asset pricing theories - 2008

Shefrin - Behavioral & Neoclassical asset pricing theories - 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

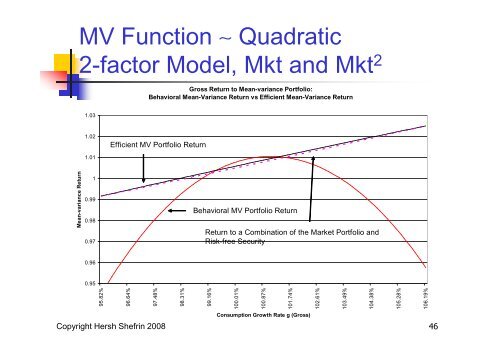

MV Function ∼ Quadratic<br />

2-factor Model, Mkt and Mkt 2<br />

Gross Return to Mean-variance Portfolio:<br />

<strong>Behavioral</strong> Mean-Variance Return vs Efficient Mean-Variance Return<br />

1.03<br />

1.02<br />

Efficient MV Portfolio Return<br />

1.01<br />

Mean-variance Return<br />

1<br />

0.99<br />

0.98<br />

0.97<br />

<strong>Behavioral</strong> MV Portfolio Return<br />

Return to a Combination of the Market Portfolio and<br />

Risk-free Security<br />

0.96<br />

0.95<br />

95.82%<br />

96.64%<br />

97.48%<br />

98.31%<br />

99.16%<br />

100.01%<br />

100.87%<br />

101.74%<br />

102.61%<br />

103.49%<br />

104.38%<br />

105.28%<br />

106.19%<br />

Consumption Growth Rate g (Gross)<br />

Copyright Hersh <strong>Shefrin</strong> <strong>2008</strong><br />

46