Annual r eport 2002 Annual r eport 2002 - Boskalis

Annual r eport 2002 Annual r eport 2002 - Boskalis

Annual r eport 2002 Annual r eport 2002 - Boskalis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements <strong>2002</strong><br />

7. Bank deposits and cash<br />

This includes € 46.9 million (2001: € 58.1 million) of joint-venture funds. In addition,<br />

at year-end <strong>2002</strong>, € 6.2 million was in frozen accounts (2001: € 15.1 million).<br />

The remaining funds at the end of <strong>2002</strong> are at free disposal. In order to hedge<br />

exchange and interest rate risks related to lease obligations for the trailing suction<br />

hopper dredger W.D. Fairway, a currency swap has been concluded and<br />

two deposits are held. The commitments related to this swap have been fully<br />

paid in advance. The discounted value of these lease obligations, amounting to<br />

€ 69.0 million as per 31 December <strong>2002</strong> (2001: € 70.1 million), is offset against<br />

the value of the currency swap and the related deposits, which also amounts to<br />

€ 69.0 million.<br />

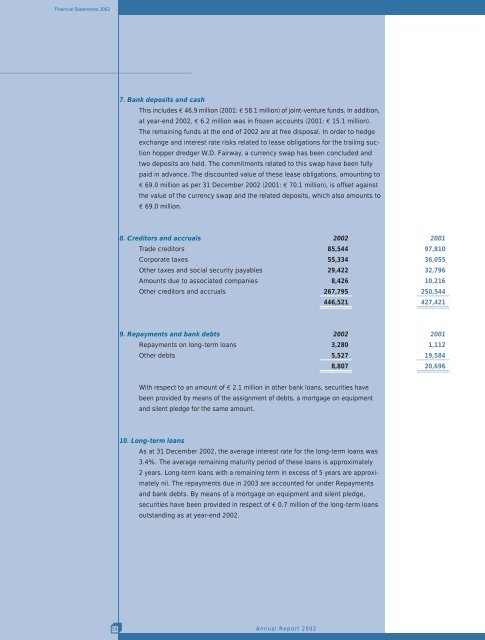

8. Creditors and accruals <strong>2002</strong> 2001<br />

Trade creditors 85,544 97,810<br />

Corporate taxes 55,334 36,055<br />

Other taxes and social security payables 29,422 32,796<br />

Amounts due to associated companies 8,426 10,216<br />

Other creditors and accruals 267,795 250,544<br />

446,521 427,421<br />

9. Repayments and bank debts <strong>2002</strong> 2001<br />

Repayments on long-term loans 3,280 1,112<br />

Other debts 5,527 19,584<br />

8,807 20,696<br />

With respect to an amount of € 2.1 million in other bank loans, securities have<br />

been provided by means of the assignment of debts, a mortgage on equipment<br />

and silent pledge for the same amount.<br />

10. Long-term loans<br />

As at 31 December <strong>2002</strong>, the average interest rate for the long-term loans was<br />

3.4%. The average remaining maturity period of these loans is approximately<br />

2 years. Long-term loans with a remaining term in excess of 5 years are approximately<br />

nil. The repayments due in 2003 are accounted for under Repayments<br />

and bank debts. By means of a mortgage on equipment and silent pledge,<br />

securities have been provided in respect of € 0.7 million of the long-term loans<br />

outstanding as at year-end <strong>2002</strong>.<br />

54<br />

<strong>Annual</strong> R<strong>eport</strong> <strong>2002</strong>