Annual r eport 2002 Annual r eport 2002 - Boskalis

Annual r eport 2002 Annual r eport 2002 - Boskalis

Annual r eport 2002 Annual r eport 2002 - Boskalis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements <strong>2002</strong><br />

In principle, positions in foreign currencies are fully hedged, usually by means<br />

of forward contracts. Financial derivatives (forward contracts, options, etc.) are<br />

not used unless there is an underlying real transaction. In respect of controlling<br />

interest risks, the premise is that, in principle, interest rates for long-term loans<br />

payable are fixed for the entire maturity period. This is achieved by contracting<br />

loans with a fixed interest rate or by using derivatives, such as interest rate swaps.<br />

Given the nature of the activities and the corresponding strong fluctuations in<br />

cash flows, the available cash funds are usually not tied up for periods longer<br />

than one year. Royal <strong>Boskalis</strong> Westminster nv applies a strict acceptance and<br />

hedging policy with regard to political and payment risks. In principle, payment<br />

risks are hedged by means of bank guarantees, insurance, etc., except in the case<br />

of credit-worthy, first-class debtors. These procedures and the geographical<br />

diversification of the group companies’ activities reduce the risk carried by Royal<br />

<strong>Boskalis</strong> Westminster nv with regard to credit concentration and market risks.<br />

Financial instruments accounted for on the balance sheet. Financial instruments<br />

accounted for under assets and liabilities are financial fixed assets, cash and<br />

accounts receivable, as well as short- and long-term liabilities. The estimated<br />

real value of these financial instruments resembles the nominal value.<br />

Off-balance-sheet financial instruments. The market value of the off-balance-sheet<br />

financial instruments as at 31 December <strong>2002</strong> reflects the unrealized result at<br />

revaluation of the contracts against calculated forward exchange rates.<br />

As at 31 December <strong>2002</strong> the unrealized positive result amounts to € 39 million<br />

(2001: € 1 million negative). These unrealized results have been taken into account<br />

in the determination of the book value of the underlying balance sheet items or<br />

the estimate of the results for ongoing projects and acquired orders.<br />

The nominal value is € 362 million (2001: € 264 million).<br />

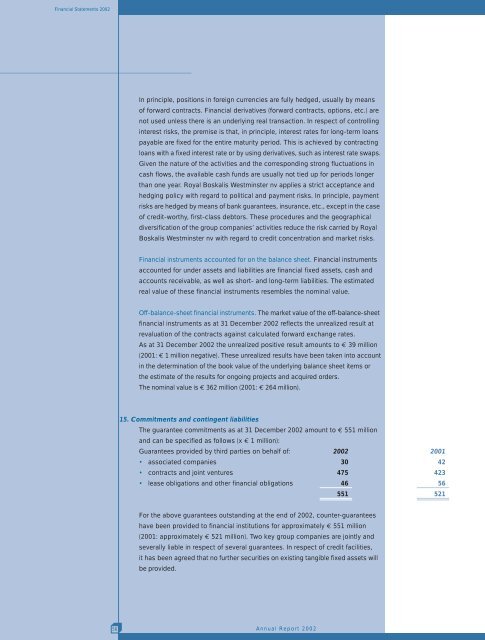

15. Commitments and contingent liabilities<br />

The guarantee commitments as at 31 December <strong>2002</strong> amount to € 551 million<br />

and can be specified as follows (x € 1 million):<br />

Guarantees provided by third parties on behalf of: <strong>2002</strong> 2001<br />

• associated companies 30 42<br />

• contracts and joint ventures 475 423<br />

• lease obligations and other financial obligations 46 56<br />

551 521<br />

For the above guarantees outstanding at the end of <strong>2002</strong>, counter-guarantees<br />

have been provided to financial institutions for approximately € 551 million<br />

(2001: approximately € 521 million). Two key group companies are jointly and<br />

severally liable in respect of several guarantees. In respect of credit facilities,<br />

it has been agreed that no further securities on existing tangible fixed assets will<br />

be provided.<br />

56<br />

<strong>Annual</strong> R<strong>eport</strong> <strong>2002</strong>