Annual r eport 2002 Annual r eport 2002 - Boskalis

Annual r eport 2002 Annual r eport 2002 - Boskalis

Annual r eport 2002 Annual r eport 2002 - Boskalis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statements <strong>2002</strong><br />

The bonuses were given for the achievement of certain targets during the 2001<br />

financial year. In 2001, the remuneration for members of the Board of Management<br />

and Supervisory Board amounted to € 1.6 million and € 0.1 million respectively.<br />

No loans or guarantees have been provided to, or on behalf of, the managing<br />

and supervisory directors. At the end of <strong>2002</strong>, the group companies included in<br />

the consolidation had a total of 3,285 employees (2001: 3,119) of whom 1,804<br />

(2001: 1,865) were paid on a weekly basis. The average number of employees<br />

in <strong>2002</strong> was 3,192 (2001: 3,257).<br />

20. Social security costs<br />

These include an amount of € 11.4 million for pension costs (2001: € 7.5 million).<br />

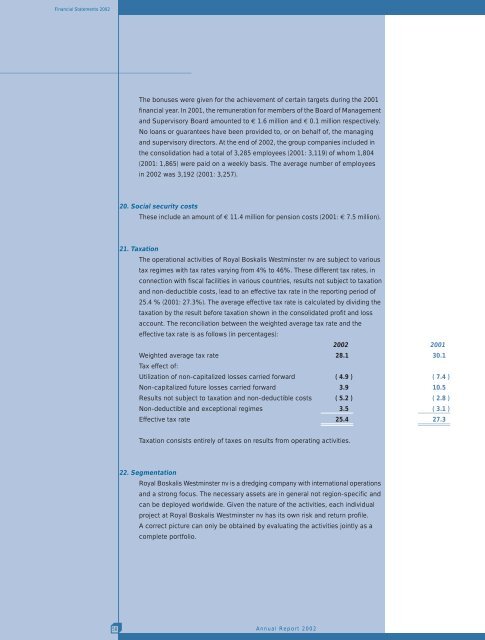

21. Taxation<br />

The operational activities of Royal <strong>Boskalis</strong> Westminster nv are subject to various<br />

tax regimes with tax rates varying from 4% to 46%. These different tax rates, in<br />

connection with fiscal facilities in various countries, results not subject to taxation<br />

and non-deductible costs, lead to an effective tax rate in the r<strong>eport</strong>ing period of<br />

25.4 % (2001: 27.3%). The average effective tax rate is calculated by dividing the<br />

taxation by the result before taxation shown in the consolidated profit and loss<br />

account. The reconciliation between the weighted average tax rate and the<br />

effective tax rate is as follows (in percentages):<br />

<strong>2002</strong> 2001<br />

Weighted average tax rate 28.1 30.1<br />

Tax effect of:<br />

Utilization of non-capitalized losses carried forward ( 4.9 ) ( 7.4 )<br />

Non-capitalized future losses carried forward 3.9 10.5<br />

Results not subject to taxation and non-deductible costs ( 5.2 ) ( 2.8 )<br />

Non-deductible and exceptional regimes 3.5 ( 3.1 )<br />

Effective tax rate 25.4 27.3<br />

Taxation consists entirely of taxes on results from operating activities.<br />

22. Segmentation<br />

Royal <strong>Boskalis</strong> Westminster nv is a dredging company with international operations<br />

and a strong focus. The necessary assets are in general not region-specific and<br />

can be deployed worldwide. Given the nature of the activities, each individual<br />

project at Royal <strong>Boskalis</strong> Westminster nv has its own risk and return profile.<br />

A correct picture can only be obtained by evaluating the activities jointly as a<br />

complete portfolio.<br />

58<br />

<strong>Annual</strong> R<strong>eport</strong> <strong>2002</strong>