2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106<br />

Notes to the consolidated and separate financial statements<br />

continued …<br />

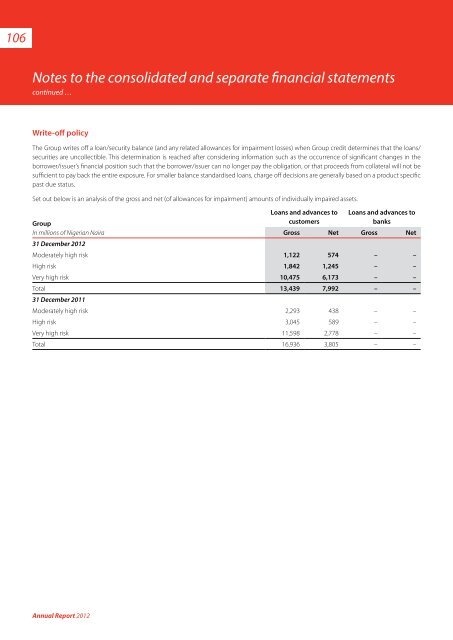

Write-off policy<br />

The Group writes off a loan/security balance (and any related allowances for impairment losses) when Group credit determines that the loans/<br />

securities are uncollectible. This determination is reached after considering information such as the occurrence of significant changes in the<br />

borrower/issuer’s financial position such that the borrower/issuer can no longer pay the obligation, or that proceeds from collateral will not be<br />

sufficient to pay back the entire exposure. For smaller balance standardised loans, charge off decisions are generally based on a product specific<br />

past due status.<br />

Set out below is an analysis of the gross and net (of allowances for impairment) amounts of individually impaired assets.<br />

Group<br />

In millions of Nigerian Naira<br />

31 December <strong>2012</strong><br />

Loans and advances to<br />

customers<br />

Loans and advances to<br />

banks<br />

Gross Net Gross Net<br />

Moderately high risk 1,122 574 – –<br />

High risk 1,842 1,245 – –<br />

Very high risk 10,475 6,173 – –<br />

Total 13,439 7,992 – –<br />

31 December 2011<br />

Moderately high risk 2,293 438 – –<br />

High risk 3,045 589 – –<br />

Very high risk 11,598 2,778 – –<br />

Total 16,936 3,805 – –<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>