2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

126<br />

Notes to the consolidated and separate financial statements<br />

continued …<br />

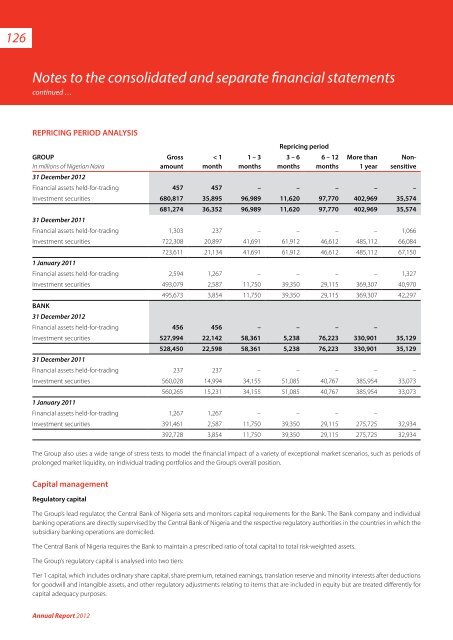

REPRICING PERIOD ANALYSIS<br />

GROUP<br />

In millions of Nigerian Naira<br />

31 December <strong>2012</strong><br />

Gross<br />

amount<br />

< 1<br />

month<br />

1 – 3<br />

months<br />

Repricing period<br />

3 – 6<br />

months<br />

6 – 12<br />

months<br />

More than<br />

1 year<br />

Nonsensitive<br />

<strong>Financial</strong> assets held-for-trading 457 457 – – – – –<br />

Investment securities 680,817 35,895 96,989 11,620 97,770 402,969 35,574<br />

681,274 36,352 96,989 11,620 97,770 402,969 35,574<br />

31 December 2011<br />

<strong>Financial</strong> assets held-for-trading 1,303 237 – – – – 1,066<br />

Investment securities 722,308 20,897 41,691 61,912 46,612 485,112 66,084<br />

723,611 21,134 41,691 61,912 46,612 485,112 67,150<br />

1 January 2011<br />

<strong>Financial</strong> assets held-for-trading 2,594 1,267 – – – – 1,327<br />

Investment securities 493,079 2,587 11,750 39,350 29,115 369,307 40,970<br />

495,673 3,854 11,750 39,350 29,115 369,307 42,297<br />

Bank<br />

31 December <strong>2012</strong><br />

<strong>Financial</strong> assets held-for-trading 456 456 – – – –<br />

Investment securities 527,994 22,142 58,361 5,238 76,223 330,901 35,129<br />

528,450 22,598 58,361 5,238 76,223 330,901 35,129<br />

31 December 2011<br />

<strong>Financial</strong> assets held-for-trading 237 237 – – – – –<br />

Investment securities 560,028 14,994 34,155 51,085 40,767 385,954 33,073<br />

560,265 15,231 34,155 51,085 40,767 385,954 33,073<br />

1 January 2011<br />

<strong>Financial</strong> assets held-for-trading 1,267 1,267 – – – –<br />

Investment securities 391,461 2,587 11,750 39,350 29,115 275,725 32,934<br />

392,728 3,854 11,750 39,350 29,115 275,725 32,934<br />

The Group also uses a wide range of stress tests to model the financial impact of a variety of exceptional market scenarios, such as periods of<br />

prolonged market liquidity, on individual trading portfolios and the Group’s overall position.<br />

Capital management<br />

Regulatory capital<br />

The Group’s lead regulator, the Central Bank of Nigeria sets and monitors capital requirements for the Bank. The Bank company and individual<br />

banking operations are directly supervised by the Central Bank of Nigeria and the respective regulatory authorities in the countries in which the<br />

subsidiary banking operations are domiciled.<br />

The Central Bank of Nigeria requires the Bank to maintain a prescribed ratio of total capital to total risk-weighted assets.<br />

The Group’s regulatory capital is analysed into two tiers:<br />

Tier 1 capital, which includes ordinary share capital, share premium, retained earnings, translation reserve and minority interests after deductions<br />

for goodwill and intangible assets, and other regulatory adjustments relating to items that are included in equity but are treated differently for<br />

capital adequacy purposes.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>