2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

164<br />

Notes to the consolidated and separate financial statements<br />

continued …<br />

36. Borrowings continued …<br />

36.1 This represents the amount drawn down under the African Development Bank (AfDB) long-term unsecured loan facilities. The AfDB<br />

borrowing comprises an unsecured emergency liquidity funding (ELF) and an unsecured trade finance initiative facility (TFI). Interest<br />

rate on the ELF is six (6) months USD LIBOR plus 500 basis points. Interest rate on the TFI is six (6) months USD LIBOR plus 450 basis<br />

points. Interest on both the ELF and TFI loans are payable semi-annually.<br />

36.2 Amount represents on-lending facilities provided by the Central Bank of Nigeria (CBN) with the sole purpose of granting loans, at<br />

subsidised rates, to companies engaged in agriculture. The funds are at concessionary rates.<br />

36.3 Amount represents on-lending facilities provided by the Bank of Industry (BoI) with the sole purpose of granting loans, at subsidised<br />

rates, to companies engaged in manufacturing, power and aviation industries. The funds are at concessionary rates.<br />

36.4 This represents the amount drawn down under a secured term loan facility granted by Afrexim and amount drawn down under a<br />

guaranteed note purchase. Interest rate on the term loan facility is three (3) months USD LIBOR plus 430 basis points while Interest<br />

rate on the guaranteed note purchase facility is three (3) months USD LIBOR plus 475 basis points. Interests on the loans are payable<br />

quarterly.<br />

36.5 This represents the amount drawn down under a secured term loan facilities granted by Standard Chartered Bank. The borrowing<br />

comprises a term loan facility of USD55 million and a term loan facility of NGN equivalent of USD45 million. Interest rate on the<br />

USD55 million term loan facility is six (6) months USD LIBOR plus 450 basis points. Interest rate on the USD45 million term loan is six (6)<br />

months USD LIBOR plus 530 basis points. Interest on both term loans are payable semi-annually.<br />

36.6 This represents the amount drawn down under a HSBC Export Credit Agency-backed framework agreement facility. Interest rate on<br />

the facility is six (6) months USD LIBOR plus 125 basis points. Interest on the loan is payable semi-annually.<br />

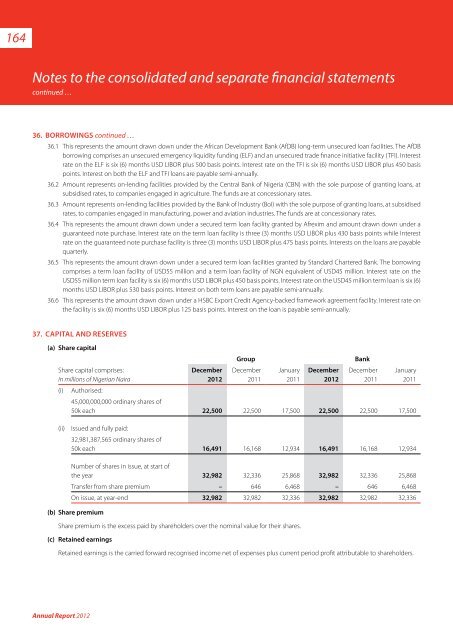

37. Capital and reserves<br />

(a) Share capital<br />

Share capital comprises:<br />

In millions of Nigerian Naira<br />

(i) Authorised:<br />

December<br />

<strong>2012</strong><br />

Group<br />

December<br />

2011<br />

January<br />

2011<br />

December<br />

<strong>2012</strong><br />

Bank<br />

December<br />

2011<br />

January<br />

2011<br />

45,000,000,000 ordinary shares of<br />

50k each 22,500 22,500 17,500 22,500 22,500 17,500<br />

(ii)<br />

Issued and fully paid:<br />

32,981,387,565 ordinary shares of<br />

50k each 16,491 16,168 12,934 16,491 16,168 12,934<br />

Number of shares in issue, at start of<br />

the year 32,982 32,336 25,868 32,982 32,336 25,868<br />

Transfer from share premium – 646 6,468 – 646 6,468<br />

On issue, at year-end 32,982 32,982 32,336 32,982 32,982 32,336<br />

(b) Share premium<br />

Share premium is the excess paid by shareholders over the nominal value for their shares.<br />

(c) Retained earnings<br />

Retained earnings is the carried forward recognised income net of expenses plus current period profit attributable to shareholders.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>